What's Top Of Mind For Ag Lenders Right Now

Farmer Mac and the Agricultural Bankers Association (ABA) have released the results of their annual ag lender survey.

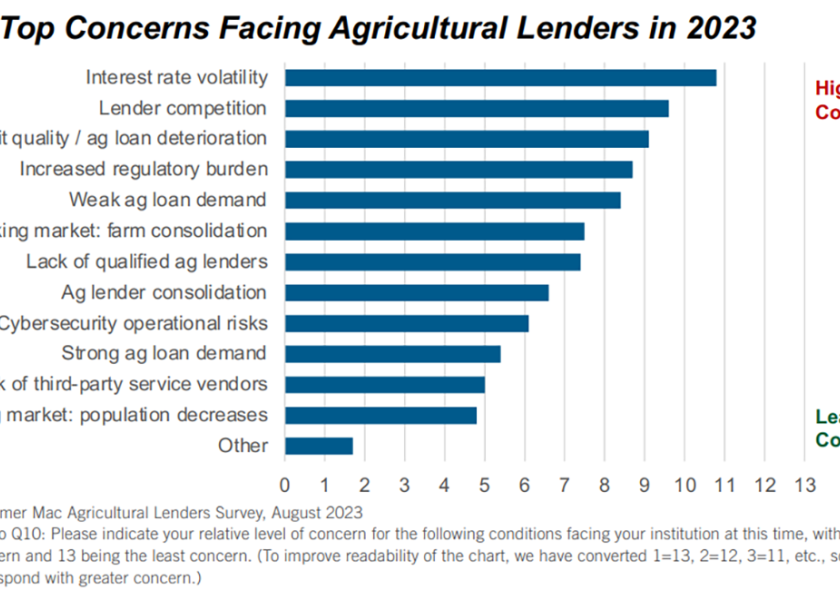

Looking at the farm economy as well as lending conditions, over 260 ag lenders ranked their top 12 concerns for what institutions and producers are facing.

No. 1 Worry

Ag lenders reported their top concern for what is facing institutions as interest rate volatility for the second year in a row.

“I think it comes as no surprise this is the No. 1 concern,” says Tyler Mondres, senior director of research at ABA. “A lot of the concern around the other items listed stems from the interest rate volatility we’ve experienced.”

The survey respondents were widely split on the direction they expect interest rates to take. Just over half (51.7%) believe short-term rates will continue to increase over the next year and 47.2% expect long-term rates to rise – though it’s important to note the responses were given in August.

“I would think if we resurveyed today, we would see at least the short-term interest rate outlook decline,” says Blaine Nelson, senior economist at Farmer Mac. “Long-term rates are a bit more of a convoluted story, so that may stay higher over the next 12 months, but I think short-term rates would be different.”

Competition

The interest rate environment has caused shrinking margins for lenders and is expected to cause increased competition – which respondents listed as their second highest concern.

“As the Fed increases rates, the goal is to slow the economy. If you succeed in slowing down the economy, you’re probably going to see a slowdown in loan demand from your borrowers,” Mondres says. “I think that’s why we’re seeing that heightened concern around lender competition. As rates rise, banks and other ag lenders are going to be facing stronger competition for those good deals.”

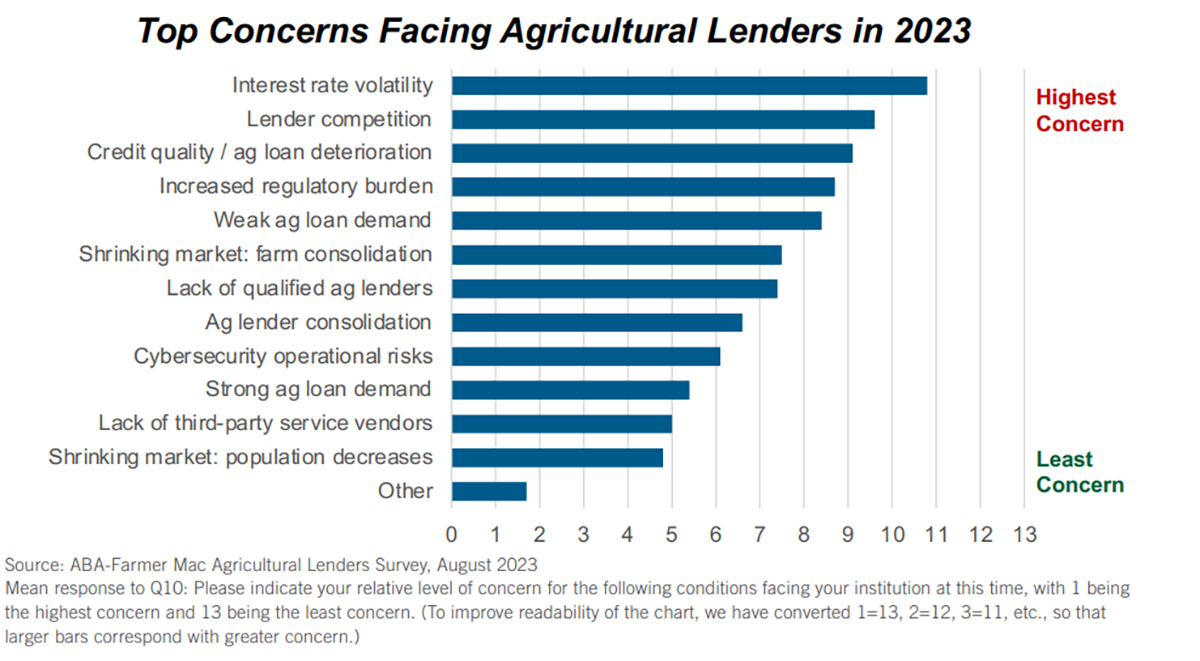

As competition increases, responses were also split on whether institutions were tightening their loan terms.

“In the last six months, we’re seeing some institutions tightening their standards, but I would say you’re seeing more ease their standards,” says Caleb Hopkins, loan production officer at First Dakota National Bank. “Competition is more fierce in the last three to six months and you’re seeing institutions chase some loans right now that they maybe wouldn’t have done six or 12 months ago.”

Credit Quality Expected to Deteriorate in Coming Year

The third most listed concern for lending institutions was credit quality.

While 95% of survey respondents reported lower ag loan delinquencies and charge-off rates in 2023, they still expect credit quality to deteriorate in the coming year.

“During the pandemic, with so much government support, we saw credit quality really strengthen,” Mondres says. “When I read these survey responses that say they’re expecting delinquencies and charge-offs to rise, my interpretation is that it’s really just an expectation for things to normalize.”

Mondres adds that the second quarter of 2023 had the lowest noncurrent rate in ag loans since the FDIC began tracking in 1984, meaning credit quality is currently at a very strong base.

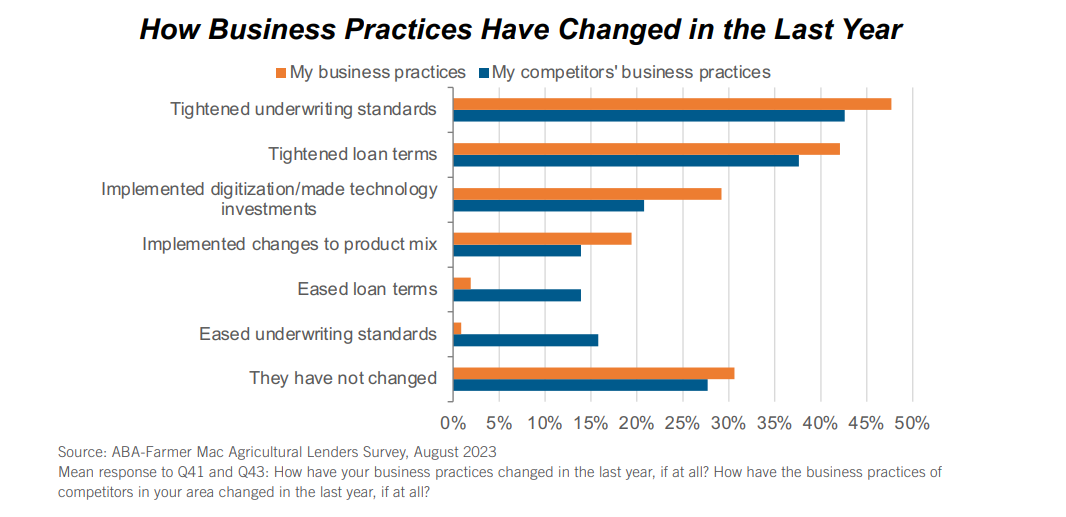

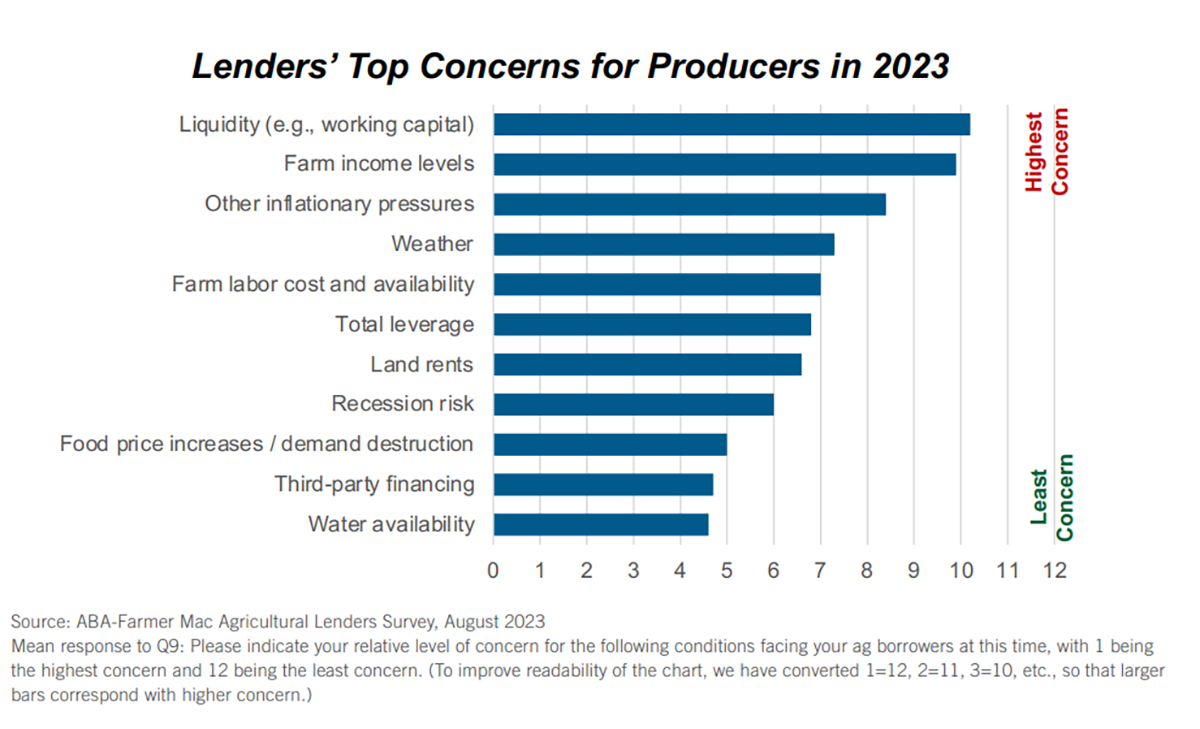

Expectations for Ag Borrowers

On the producer side, lenders listed their top concerns as liquidity, farm income levels and other inflationary pressures – all of which can be linked together.

“With farm incomes being as elevated as they have been, you wouldn’t think working capital would be the No. 1 concern facing producers,” Nelson says. “What USDA is putting out is that folks are using their working capital, even with elevated incomes, to pay for things both because stuff costs more and because interest rates have spiked.”

Hopkins adds, “When you look at liquidity and inflation, those go hand-in-hand. In the feeder cattle business, what it takes to operate is significantly higher than it was 12 months ago. And when you start looking at farm income levels, producers have seen these interest rates rise up, but they haven't seen them hit the income statement.”

Despite this combination, ag lenders estimated that more than three-quarters of their borrowers will remain profitable in 2023 and two-thirds will remain profitable through 2024.

“I would classify 2023 as a bit of a transition year and I think the survey respondents certainly did,” Nelson says. “When you look at the next 12 months, what you see is the return to a kind of pre-2021 profitability outlook. In 2016 to 2020, farm profitability declined on a year-over-year basis and that’s what they’re expecting for 2024.”

Over the next 12 months, lenders reported they expect farm income compression, with 70% projecting a decline in profitability.

Click here to view the full report.