2024 Land Value Influencers in Your Region

Using a combination of data with boots on the ground experience, Peoples Company has released its fourth annual land values report.

The report shows a three-year period of remarkable land appreciation across the country – something Bruce Sherrick, professor and director of the TIAA Center for Farmland Research at the University of Illinois, says has not been surprising.

“We kind of have a rolling narrative around this and quite often people will remark it’s shocking that farmland almost anticipated inflation or that it's shocking how well that's done through time. And I don't think I'm surprised by that,” he says. “I’m surprised by the accuracy or the degree or the strength of that relationship if anything.”

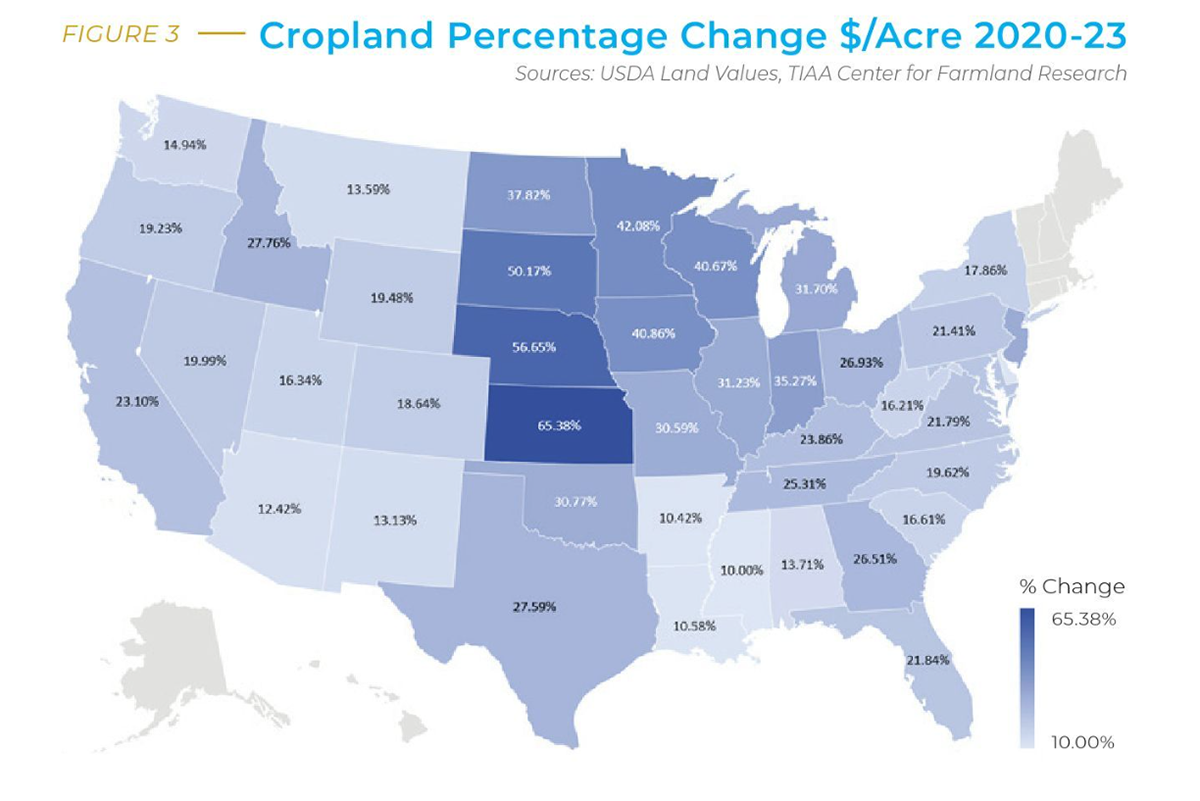

Annual rates of return have been in the double digits for many regions. In the Northern Plains region specifically, the rate of change in the past year has been especially high.

“In the last year, what we've seen is really quite remarkable in the middle of the country,” Sherrick says. “That area has kind of caught up to previous years in the Midwest and Lake states.”

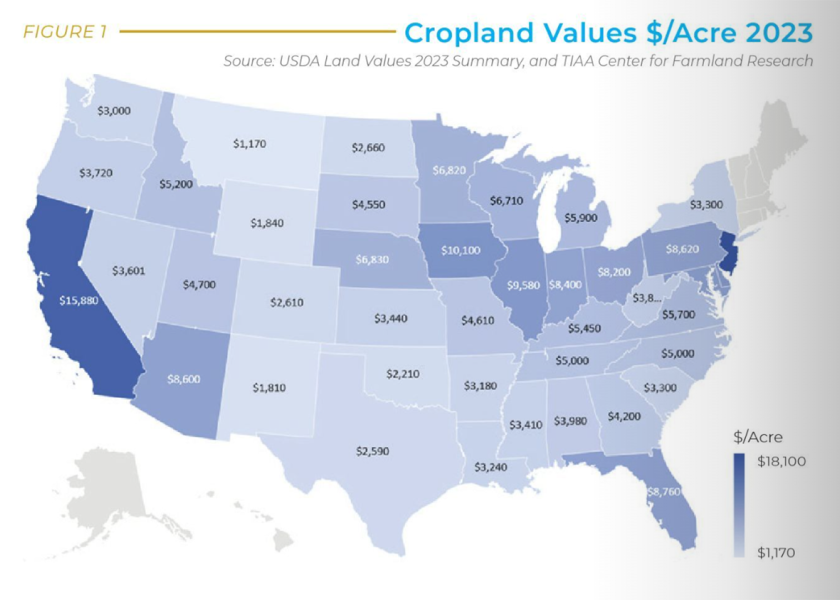

As far as what’s affecting land values in the rest of the country, Peoples Company breaks the data into eight regions.

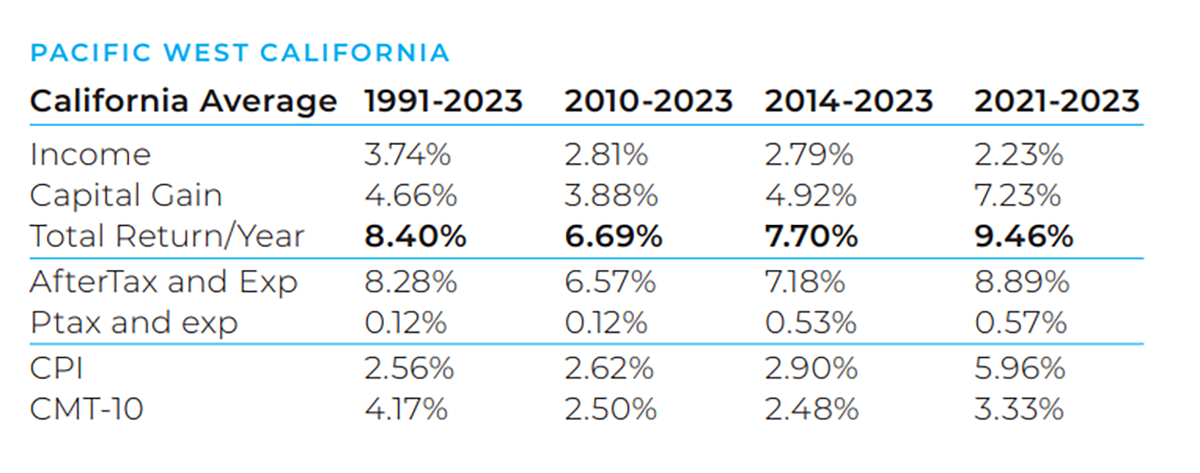

Pacific West

Annual performance on permanent cropland in the Pacific West and California has suffered in recent years due to a period of low nut prices, tariffs, water challenges and high operating capital.

3 Unique Characteristics of The Permanent Crop Industry

Steve Bruere, president of Peoples Company, anticipates a lot of land transactions in the California market in 2024.

“The amount of irrigated, plantable acreage is shrinking,” he adds. “The acreage left standing will be more valuable over time because of the optionality of what you can grow on it.”

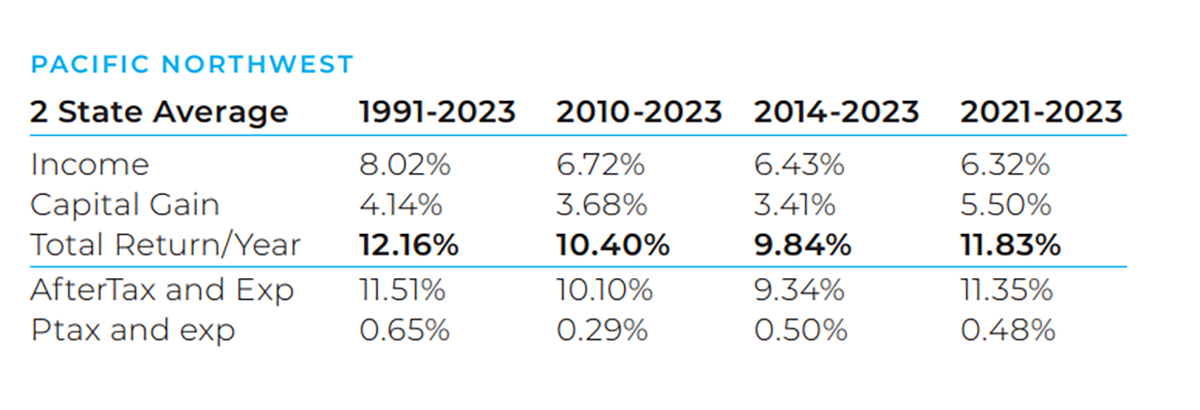

Pacific Northwest

Similar to the Pacific West, the Pacific Northwest has had a period of good returns and offers a lot of optionality of what can be grown on the land. The land values in comparison to its western neighbors, however, are much lower to produce a similar product. That factor – alongside increased access to water resources – allows the region to absorb displaced production from other areas.

“We’re seeing at least that phase of exploration on some of those fresh market crops that may have some compressed acreage and higher water costs to deal with in California looking at the Pacific Northwest, the Columbia River Basin area in particular, as a transition point,” says Dave Muth, Peoples Company’s capital markets managing director.

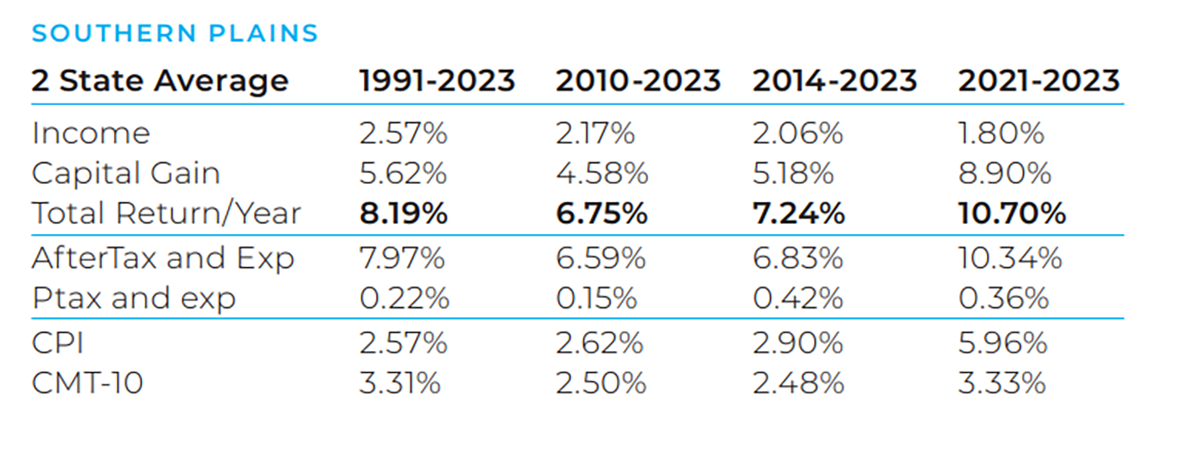

Southern Plains

The Southern Plains region – Texas and Oklahoma – is experiencing good land value returns despite water issues and labor complications. As these challenges continue, renewable energy projects are becoming key to the region’s profitability.

“Think about it: 20,30, or 40 years ago, when someone was looking to buy a ranch, if transmission lines ran across it, that might take it off the list. Now those same transmission lines are seen as a huge asset,” says Eric O’Keefe, editor of The Land Report. “This emphasis on energy, whether it be in terms of oil and gas or renewables including direct carbon capture, is going to be a complete game changer. I think it's going to be driving land values in Texas for decades to come.”

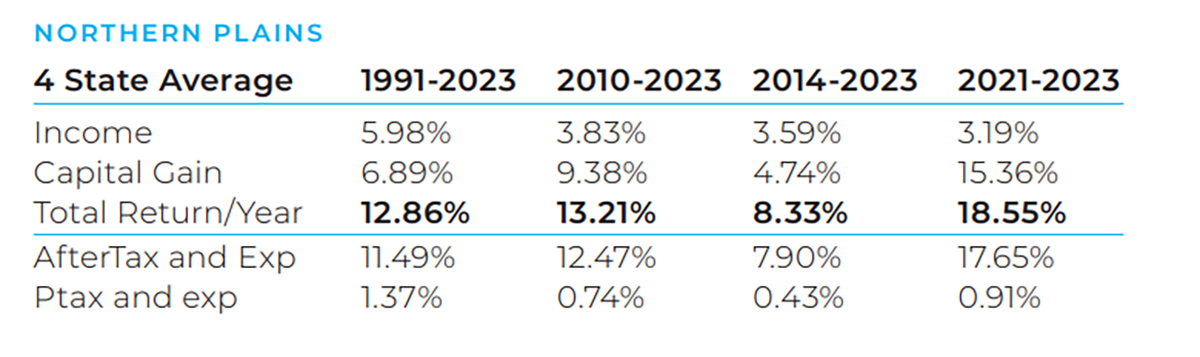

Northern Plains

Total returns per year in the Northern Plains over the past three years are averaged at 18.5% - the highest in the country.

“The increase in values have been rather dramatic compared to other parts of the country in the last three-year period. Part of that's driven by relative yield gains, but it's also the genetics and the attention to doing genetics for this part of the country by the major seed corn and other seed producers,” Sherrick says. “It has made this a possible competitor for the rest of the country.”

The focus on foreign and corporate ownership in this area also makes it unique in comparison to other regions.

“You see a difference in these types of markets where the farmers aren't driving values,” Bruere says. “If you take that institutional investor out of the market, it definitely impacts land values and we saw that real time this summer and Kansas and Colorado.”

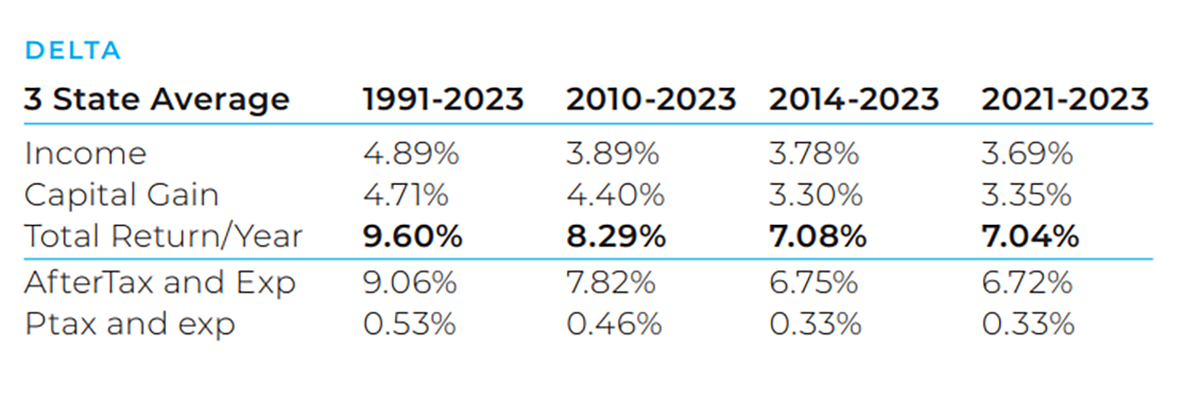

Delta Market

The Delta Market – Mississippi, Louisiana and Arkansas – has seen the most stable returns over time when compared to other regions across the country, which makes it attractive to outside investors.

“You don't get necessarily the same swings that we get in the Midwest in this market. And I'm really bullish – you’ve got plenty of water and you've got large fields,” Bruere says. “One of the issues we do struggle with in this market is the tenant pool. You don't have that same competitive nature for tenants that you've gotten Midwest.”

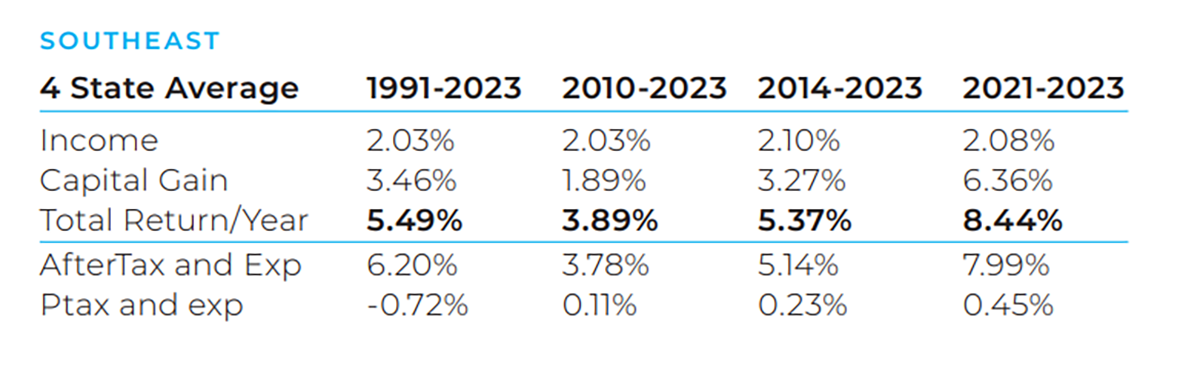

Southeast Market

The Southeast – Florida, Alabama, Georgia and South Carolina – has seen moderate returns in comparison to the other regions. The increase in severe weather as well as development in the area leads Sherrick to expect quite a bit of transition in the future.

“I'm actually not worried about land values, hardly at all in this region, for traditional agricultural things,” he says. “Land that gets displaced for a retirement community, a park, golf course or major league baseball facility aren't reductions in value. They're just a reduction in the use of it for agriculture.”

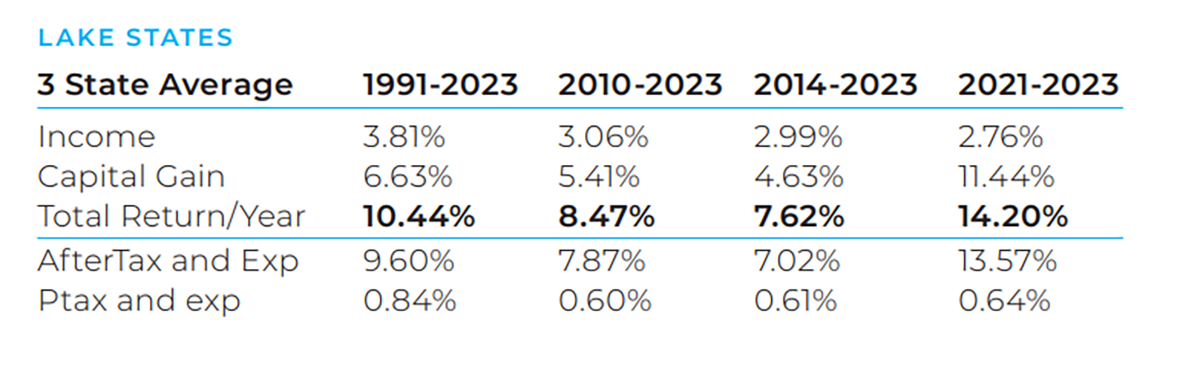

Lake States

The Great Lakes region is one Sherrick describes as “still trying to figure out who they’re going to be”.

“There’s great optionality, reasonable acquisition prices and massive increases in land values that have kind of kept the returns high, very correlated with inflation as well,” he says.

Though the yields in the region may not be as high as in the corn belt, the area’s total returns per year over the past three years have averaged 14%.

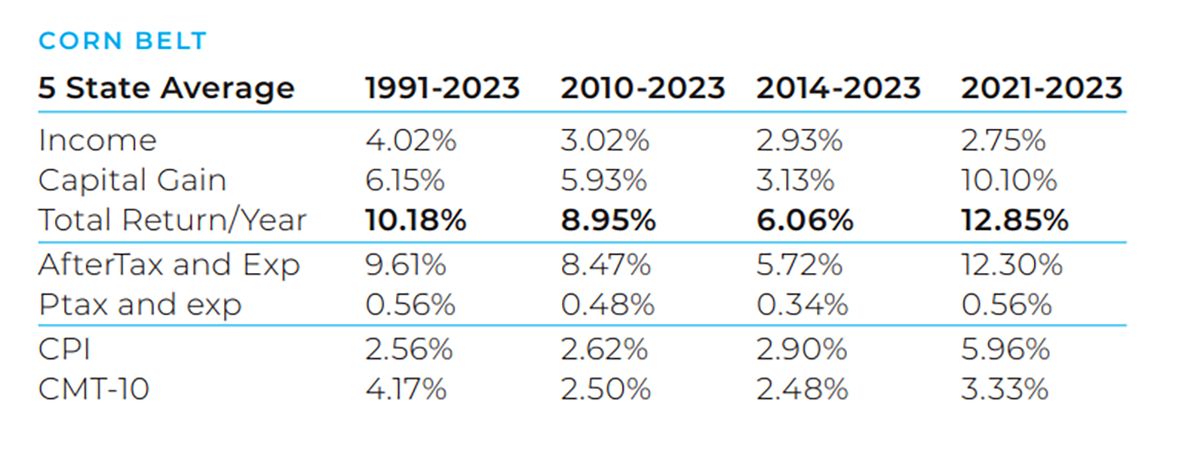

Corn Belt

Sherrick refers to Illinois and Indiana as indicators and predictors of what’s happening in the agriculture industry.

The region continues to have high appreciation values and above average farm incomes, though transactions have slowed in 2023. The corn belt is anticipated to have continued interest from non-operating investors.

Looking at 2024

Overall, Peoples Company reports the driving factors behind land values are income, interest rates and inflation. As we move into 2024, they expect this will begin to normalize.

Buyer demand is also expected to remain a key player.

“There's more money that wants to own farmland in there as farmland for sale. That dynamic is not going to change in 2024,” says Bruere. “Right now it feels like interest rates are pulling back a little bit and I think the landmark is going to remain pretty stable in 2024.”