Slowing Rural Economy Creates Negative Outlook

Economic growth is stalling in rural America. That’s according to the Rural Mainstreet Index (RMI) from Creighton University.

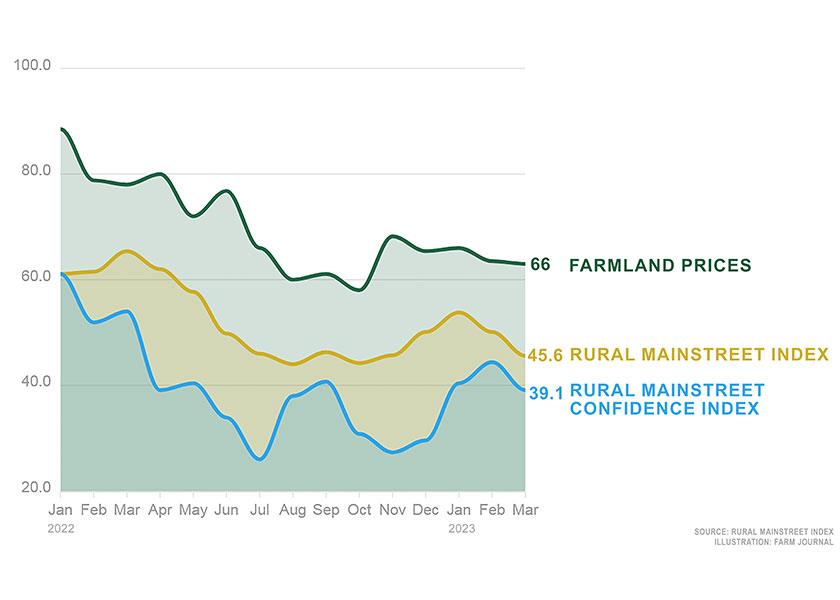

After three straight months of readings slightly above growth neutral, the RMI fell below to 45.6 in March 2023. That’s down from February’s 50.1. March’s 45.6 is the lowest reading since October of last year.

The index ranges between 0 and 100, with a reading of 50 representing growth neutral and is generated by a monthly survey of bank CEOs in rural areas of a 10-state region that are dependent on agriculture and/or energy.

“The Rural Mainstreet economy continues to experience slow, to no, to negative economic growth,” says Ernie Goss, who chairs Creighton’s Heider College of Business and leads the RMI. “Less than 1% of bankers reported improving economic conditions for the month with 92% indicating no change in economic conditions from February’s slow growth.”

The region’s farmland price index decreased to 63 from February’s 63.5. This was the 30th straight month that the index has advanced above 50.

After advancing by over 9% for 2022, bank CEOs expect farmland prices to expand by only 1% over the next 12 months.

Other key data points from the March RMI:

- Only 13.6% of bankers tightened credit standards for farm loans this year.

- Bank savings deposits rose to a record level.

- Nearly 90% of bankers recommend a Federal Reserve rate hike at its next meetings, March 21-22, with almost one-third supporting a 0.50% increase.

“It’s too bad that the Fed waited so long to raise interest rates,” says Jeffrey Gerhart, former Chair of the Independent Community Bankers of America. “They could have begun raising interest rates sooner than they did and would not have had to raise them as fast as they’ve done.”

Negative Economic Outlook

The slowing economy, higher borrowing costs and labor shortages continued to constrain the business confidence index to a weak 39 from 44 in February.

“Over the past 12 months, the regional confidence index has fallen to levels indicating a very negative outlook,” Goss says.