Why Are Some Ag Retailers Sitting on High Fertilizer Prices? Making Sense of the Disparity Right Now

Fertilizer and herbicide prices continue to fall, and there are signs the decline could continue into spring. Now the issue is the number of agricultural retailers sitting on high-priced inputs, which are often passed on to farmers.

A year ago, the headlines were focused on climbing input prices. Not only were farmers looking at a possible shortage of herbicides, there were also concerns about what the fallout from the war in Ukraine could mean for already surging fertilizer prices. In April of 2022, a Farm Journal survey found:

- 87% of retailers experienced difficulty sourcing inputs for 2022

- Of those, 85% had trouble with herbicide availability

- 38% had difficulty sourcing fertilizer

- The biggest issue was securing enough glyphosate, with 100% of respondents reporting issues with that particular chemistry

- 69% reported difficulty sourcing glufosinate

A year later, the story has dramatically changed. Active ingredients are flowing more freely from China, and declining natural gas prices are leading to less expensive fertilizer.

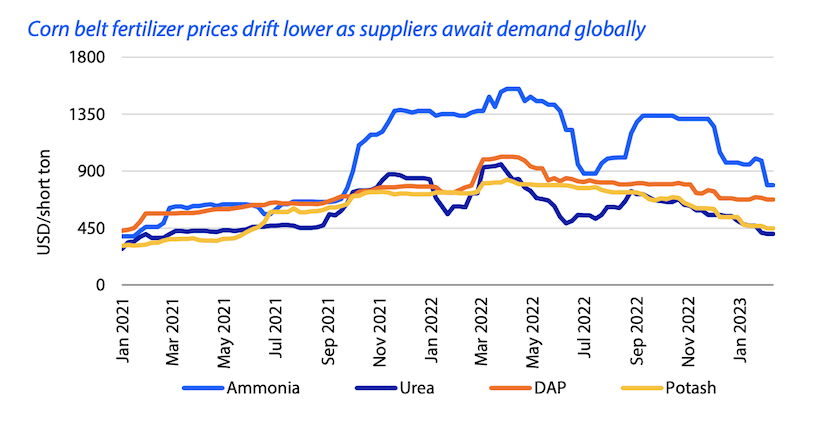

Sam Taylor, farm inputs analyst at Rabo AgriFinance in the RaboResearch Food & Agribusiness group, watches fertilizer and herbicide prices closely. He says the fertilizer market, in particular, has posted quite sizable falls even since the start of the year.

“You're seeing wholesale Midwest pricing in some of the nitrogen products down 20% since the start of this year. This is really a function of inventory, but also the natural gas price in Europe creating a less worst-case scenario, as well as potentially some of the big buyers sitting out in the market to kind of get a little bit of clarity,” says Taylor.

He says there’s been less of a fall on the phosphate side, but it's still in the double digits. Taylor expects further downside in that market in the coming weeks.

The potash market’s price decline has been more pronounced, with a 20% fall in Midwest potash prices on the retail level, according to Taylor.

With the sudden shift in prices, it creates a difficult scenario for those retailers sitting on fertilizer prices that are at a much higher level than what is posted today.

“What this very often means is that kind of over-played cliche, ‘who wants to catch the falling knife as the market's coming down?’ The independent people within that value chain, the farmer, the retailer, the distributor, they don't necessarily want to be taking hold of inventory that they might not then necessarily be able to get the value out of and that they paid for ostensibly,” Taylor explains.

Taylor thinks there’s been a front-loading of the price decline, with some fertilizer prices looking at a 30% drop since November.

“You've seen an early fall off in the pricing, and I think this has added a little bit more fear,” says Taylor. “On the nitrogen side, it has just been steeper than a lot of people have thought and this has been as a function, I would say, primariily of the weather components in the supply of natural gas in Europe. There's not necessarily anything that anyone can do to legislate for these kinds of weather forecasts or changing the landscape.”

While farmers may be annoyed with the prices they paid in the fall compared to now, some are also getting cheaper price quotes from other retailers just ahead of planting. Taylor says some of those smaller retailers, like co-ops, aren’t structured to assume a 20% to 30% fall in pricing and likely need to pass it on to growers.

As a result, consolidation in the ag retail space, which is already underway, could continue to accelerate in the years ahead.

“Scale is a great source of purchasing power, but it's also a great source of market intelligence,” says Taylor. “As there is more consolidation and potentially more integration, then you're likely to see an increasing amount of pressure put on some of the smaller guys. So, it's not at all unreasonable to think that we will continue to see consolidation in the kind of proverbial ‘mom and pop’ retail locations, and with even some of the smaller cooperatives as well, we'll likely continue to see merge going forward.”

The latest 2023 outlook from Rabo AgriFinance points out the true test for fertilizer prices is coming, and whether the price pressure will continue when demand emerges. Rabo says once spring fertilizer needs are underway, the question is whether that will then signal a bottom in the markets for nitrogen, but also where the inventory will then be held within the supply chain.

Rabo’s outlook says, “Senses remain that much inventory remains at the product producer level, as retailers and distributors stay reluctant to jump in a falling market.”

Related Stories:

Producers Eliminate Fungicide and Insecticide Use, Cut Fertilizer 50%

Are You Worried About Glufosinate Supplies in 2023? Good News. There Isn't a Shortage This Year

John Phipps: Is it Even Feasible to Bring the Production of Chips and NH3 Back to the U.S.?

Ferrie: You Can Reduce Fertilizer and Still Harvest Big Corn Yields, But Some Parameters Apply