High Production Costs Could Weigh on the Ag Economy Through 2024, New Survey of Economists Finds

Stronger cattle prices combined with the recent run-up in crop prices aren’t enough to outweigh concerns about the impact high input prices will have on farmers this year and into 2024. While most economists agree the next 12 months could produce more financial challenges for agriculture, views vary on how much financial pressure producers will see and offer differing opinions on the U.S. crop production picture and commodity/feed prices.

The results are part of the June Ag Economists’ Monthly Monitor, a new survey of nearly 50 agricultural economists from across the country. It's the first survey of its kind, collecting insights from economists who represent both the private and public sectors. The economists represent the ag sector across a wide geography and also have expertise in grains, livestock and policy.

The survey is conducted anonymously to allow the highly respected agricultural economists to speak more openly about their economic and production forecasts since their responses won't be attributed to the university, company or organization they represent. The Ag Economists' Monthly Monitor is a joint effort between the University of Missouri and Farm Journal. The university conducts the survey, collects and crunches the data while Farm Journal distributes the results.

Main Takeaways from the June Survey

Highlights from the first Ag Economists' Monthly Monitor include:

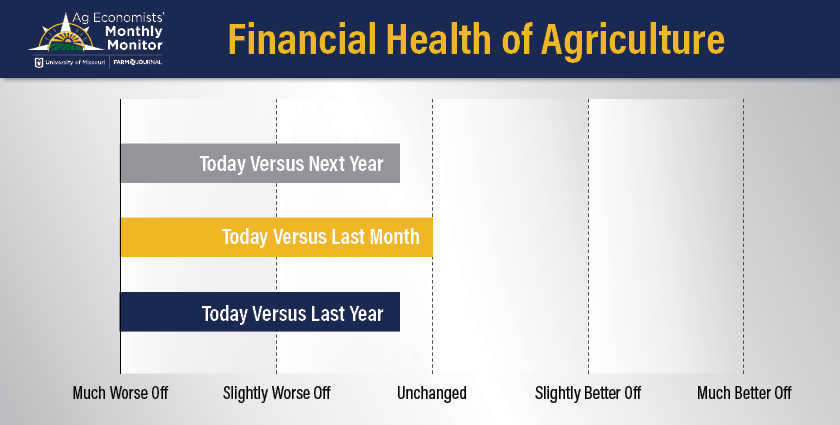

- The perceived financial health of U.S. agriculture is trending lower and is expected to continue to decline over the next 12 months.

- Production costs, global competition, geopolitical risks, drought and demand headwinds are among the main drivers.

- The majority of agricultural economists expect farm income to drift lower, with some expecting levels to land closer to the five-year average in 2024.

- High production expenses are the biggest obstacle in 2023.

- 2023 crop yield estimates vary widely among the economists surveyed.

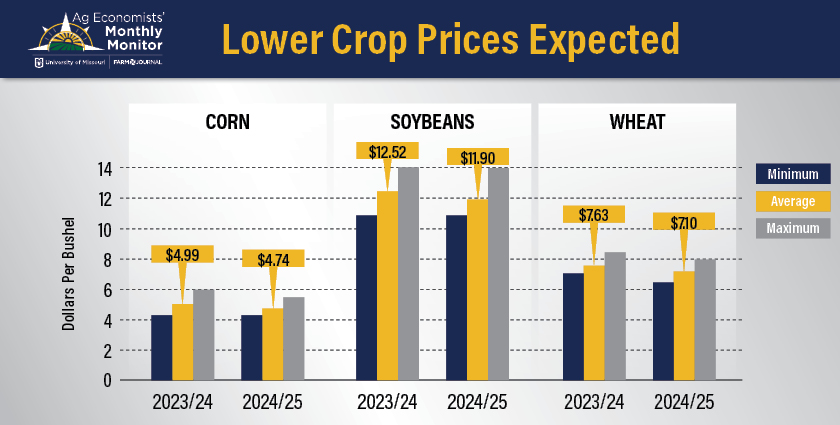

- Economists expect crop prices to drift lower in 2023 and 2024.

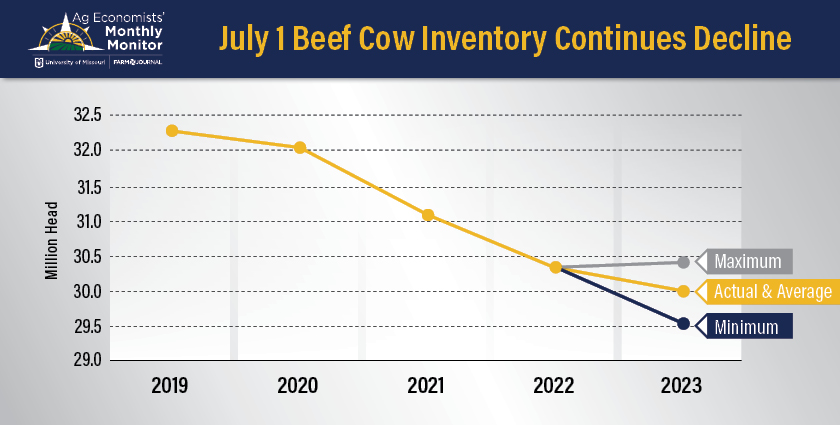

- Beef cow supplies are forecast to continue to decline this year.

A Current and Future Snapshot of the Agriculture Economy

The monitor shows the perceived financial health of U.S. agriculture has moved slightly lower over the past year, and economists expect that trend to continue over the next 12 months.

The main drivers of the waning outlook include production costs, global competition, geopolitical risks, drought and domestic demand for agricultural commodities.

“I think what's most surprising is that, on average, those more than 40 economists are in alignment with the more general perception of where agriculture is heading,” says Scott Brown, an agricultural economist with the University of Missouri, who helps author the survey. “What surprised me is the amount of volatility around that average estimate. It just reminds me there's so many issues at play today, and when trying to predict or suggest the future, even these economists have a wide opinion in terms of where we're headed in different commodities.”

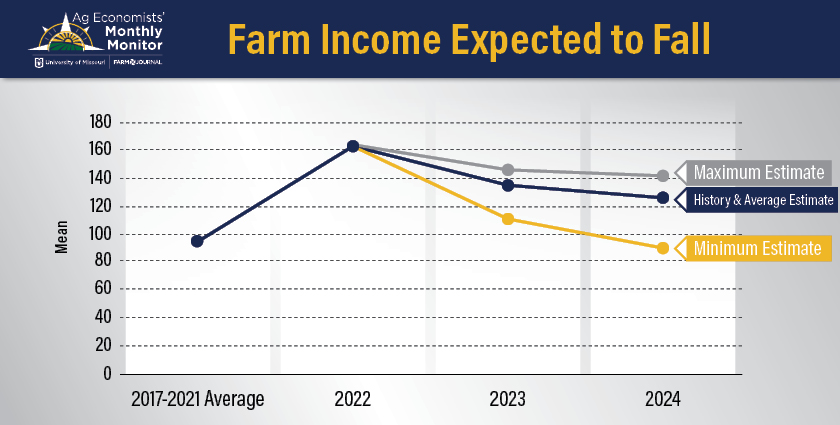

Falling Net Farm Income

The Monthly Monitor shows all respondents expect farm income to decline from the record level of 2022 for 2023 and 2024. The range of survey responses is what produced the most volatility, with responses varying by as much as $51 billion from the highest to the lowest estimate.

Some economists are projecting farm income levels to return to the 2017-21 average in 2024. The main driver for 2023 forecasts is the expectation for higher production expenses. The biggest factor for the waning outlook in 2024 is the outlook for lower commodity prices.

"It seemed like cattle was the most optimistic commodity out of the mix," Brown says. "I think there was still some expectation that corn and soybean prices could stay on the higher end, but generally there's less optimism than coming off the records we would have seen back in 2022. That's when farm income was a little north of $160 billion, and when you look at some of the forecasts for 2024 in our survey, it's closer to $120 billion on average. Some are even suggesting farm income levels could fall back to where we were pre-2020, so pre-COVID."

Wide Range of Yield Estimates

Ahead of USDA’s updated look at planted acres in the June acreage report set to be released Friday, economists don’t see many big changes compared with what farmers intended to plant in March. According to the June Ag Economists’ Monthly Monitor, the average survey result was 92.05 million planted acres for corn, which is up slightly from the 92 million acres reported by USDA’s farmer survey in March. The range included 90.5 million acres on the low end and 93 million acres on the high end.

Economists think farmers planted 87.98 million acres of soybeans this spring, slightly higher than the 87.5 million acres reported in March. The highest estimate was 89 million acres of soybeans, with the lowest estimate of 87 million acres.

In March, USDA reported farmers intended to plant 11.26 million acres of cotton. The survey showed economists think with the weather challenges in areas such as Texas, cotton farmers actually planted 11.24 million acres, with the maximum response of 11.9 million and 10.95 million on the low end.

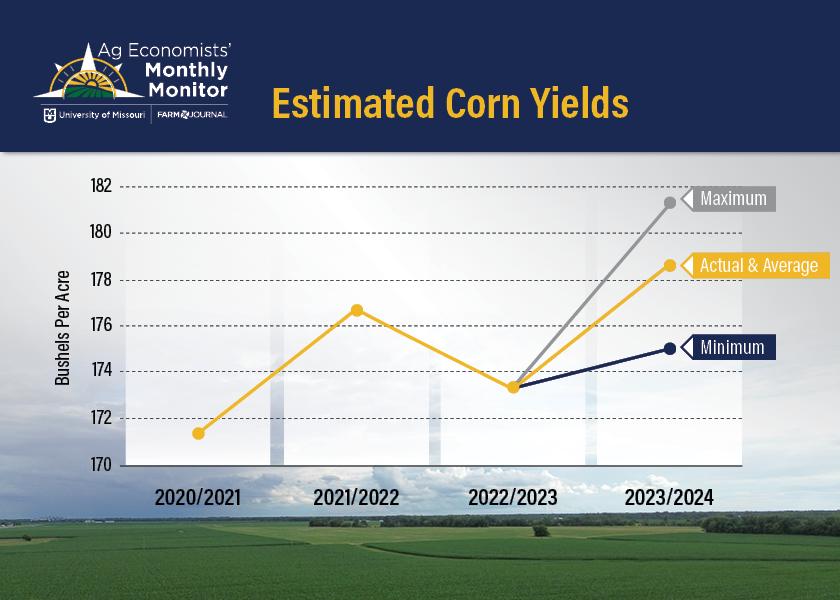

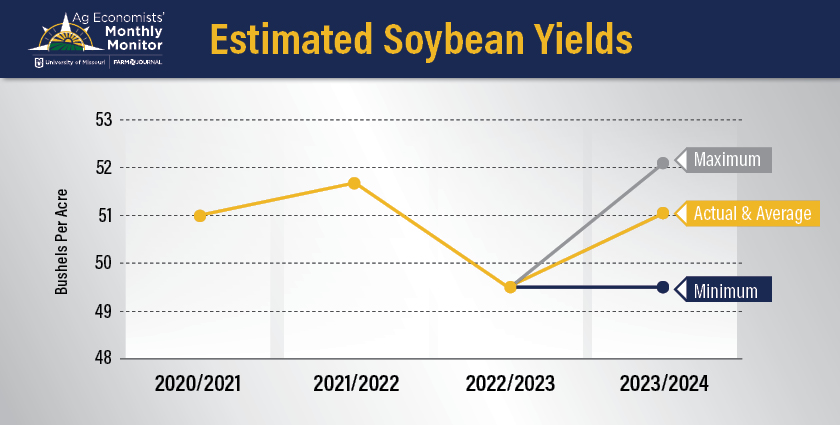

Brown points out the yield variation largely depends on upcoming weather, but the dry weather is creating a wide range of yield estimates this year. According to respondents in June, the average estimate for yield includes:

- Corn: 178.68 bu. per acre versus 181.5 bu. per acre (USDA’s current estimate)

- Soybeans: 51.06 bu. per acre versus 52 bu. per acre

- Wheat: 44.47 bu. per acre versus 44.9 bu. per acre

- Sorghum: 68.17 bu. per acre versus 69.2 bu. per acre

- Cotton: 855.18 pounds versus 841 pounds

“I think when you look at both corn and soybean acres, there wasn't a lot of deviation from the Prospective Plantings report USDA came out with a few months ago, so we didn't see a big change there,” Brown says. “On the yield side, there are certainly some differences. The average yield estimate, on the corn side from the survey was a little more than 178 bu. per acre, with a downside of 175 bu. Likewise on soybeans, that came in at about 51 bu. per acre. Both corn and soybeans are below where USDA currently sees yields. I will say those are going to change quickly as we look at weather and what's occurred since the survey would have gone out roughly a week ago now.”

Economists also expect crop prices to decline this year and next; however, there is a wide range in estimates signaling volatility will continue.

The average corn price is estimated to hit $4.99 per bushel for the current crop year and $4.74 for 2024/2025. The high range of the estimate for this year is $6 per bushel, with a low of $4.25 per bushel. Soybeans are also expected to trend lower, with an average estimate of $12.52 per bushel this year. The high came in at $14 per bushel. The low estimate was $10.85 per bushel. The average estimate for 2024/2025 is $11.90 per bushel.

Wheat prices are estimated to average $7.63 per bushel this year, with a low of $7 and a high of $8.49. The average estimate for wheat prices in 2024/2025 is $7.10 per bushel, with a high of $8 and a low of $6.49.

Mixed Outlook on Livestock

The June Ag Economists’ Monthly Monitor also asked economists to provide estimates about beef cow inventory as of July 1, which is a report USDA will release on July 21. Economists who responded expect cow inventory to fall to 30 million head, which represents a decline of 1.2%.

Respondents also see fed cattle prices in 2024 trending to over $181 per hundredweight. But responses also produced high volatility, with one economist even thinking fed cattle prices will average above $195 per hundredweight in 2024.

Most everyone expects a contraction,” Brown says. “With the dry weather we've had in cattle country, Oklahoma, Kansas, Nebraska, Missouri, to name a few, I think we will continue to see fewer beef cows when we get that report out in mid-July. There were some who are even calling for larger declines than the nearly 30 million head. It reminds me we're going to get tighter, and we're not done talking about record cattle prices if these forecasts hold true.”

Economists are less optimistic about hog prices and milk prices producers will receive this year.

Ahead of the next Hogs and Pigs report from USDA later this week, economists think the breeding hog inventory will be 99.27%, compared to 100.5% one year ago. Economists are more bullish when it comes to exports, but not enough to improve their outlook on hog prices.

"They weren't as optimistic on cattle or dairy," says Brown. "When you look at what they were saying for 2024 hog prices, still, the average was below $61. Which if costs stay where they are today, that means red ink continues into 2024. Likewise, the projected all milk price for 2024 is $20.50 in our survey. That probably also makes red ink in 2024."

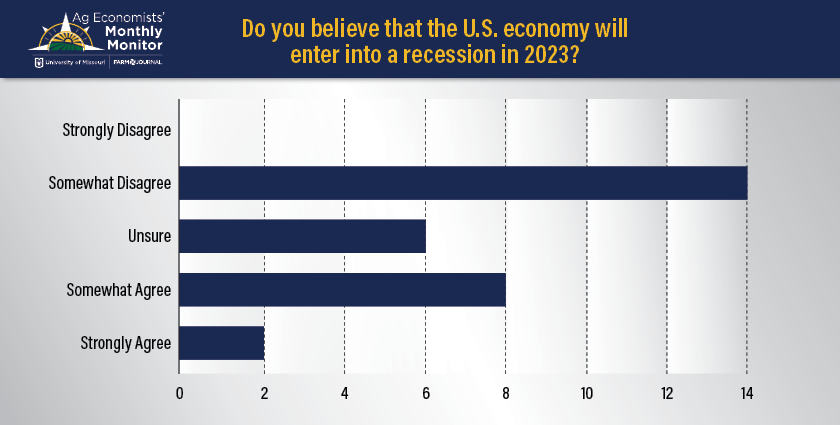

The Likelihood of a U.S. Recession

Another major economic indicator for livestock producers is the general economy, as it historically has a direct impact on domestic demand. Of those surveyed, economists expect interest rates to move up 2% over the next six months.

“Although there was a wide range of responses, most economists felt the U.S. economy is not currently in a recession and will not enter one during 2023,” Brown says. “I will point out, though, there appears to be continued uncertainty about the expected general economy health for 2023, given survey responses.”

The majority of economists "somewhat disagree" the U.S. will enter into a recession this year. While at least eight economists say they "somewhat agree" a recession is looming yet this year.

Looking Ahead to July

The June Ag Economists’ Monthly Monitor survey is a current snapshot of economists’ views. The survey will be sent to participating economists just days after USDA releases its WASDE report each month. Less than two weeks later, the results will be released.

“It is fairly current, but I'll just say weather matters a lot, as we talked about, especially with yields. We'll see how this changes, being able to now come back to the same group and ask what they expect corn and soybean yields to be in another few weeks. We’ll also have the first survey under our belt, and it will be interesting to watch those changes,” Brown says.

Looking to the second survey, Brown says he’s interested in watching changes to the crop-yield side of the equation. Longer-term, he thinks the monthly monitor will reveal bigger trends about the general economic health across all of agriculture and how those forecasts change from month to month.

“I'm really curious to watch [the general economic health] as we get more observations, and see what July looks like relative to June in terms of overall economic health,” he says. “I'm curious to watch as this group of experts continues to digest what's happening in agriculture.”