From Shockers To Snoozers, Here Are The Big Takeaways From FBN's Farmer Planting Survey

Acreage Preview 032922

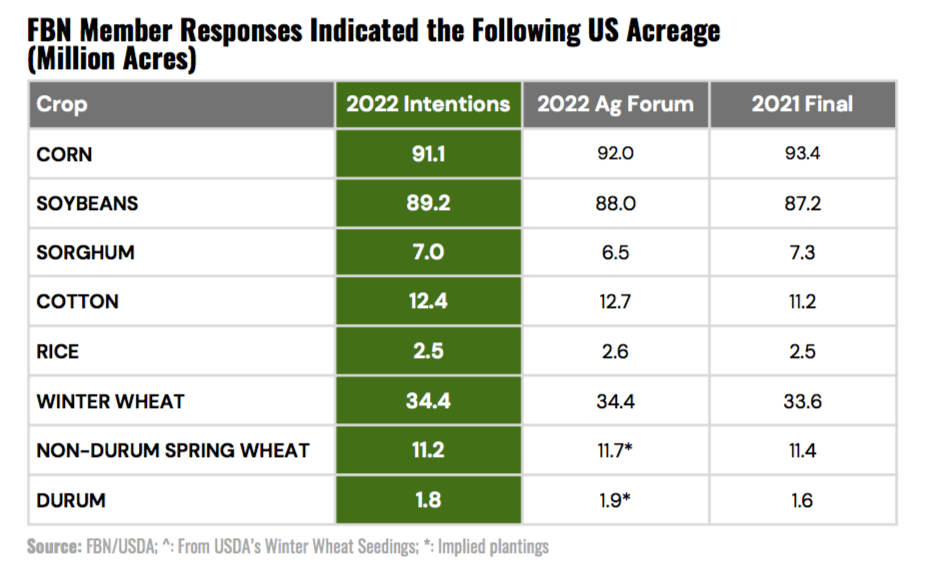

Four days ahead of USDA’s March Prospective Plantings Report, FBN released acreage survey results of its farmer members, and it shows farmers plan to plant fewer corn acres and more soybean acres in 2022. The survey also found a slight decline in spring wheat acres, despite the 40% rally in prices since the crisis in Ukraine began.

In an early, exclusive interview with FBN’s chief economist, Kevin McNew, the 2022 Planting Report results were reaped from a survey of growers in 40 states, accounting for more than 4.2 million crop acres. While McNew declined to say just how many growers responded to the survey, he says the response was larger than what FBN experienced last year when it conducted the first planting survey.

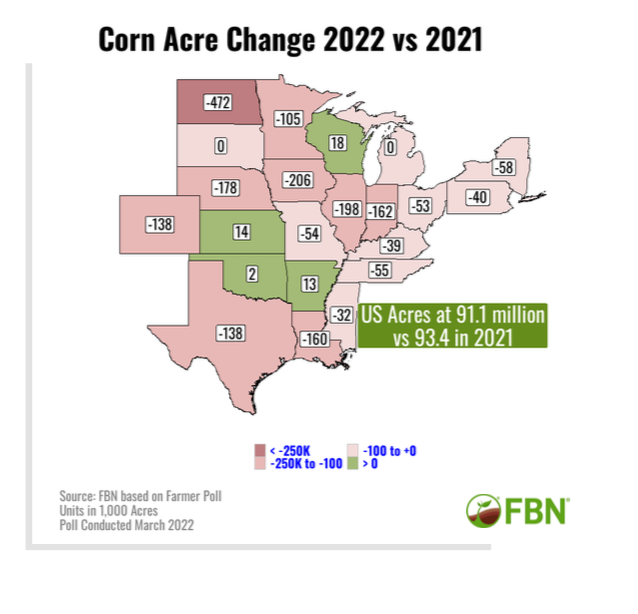

“I think the biggest takeaway we had was that there are so many crops that have really elevated prices, that farmers were not really locked in on any one crop to switch to,” says McNew. “We did see some movement back away from corn that was expected by the trade. Our number is at 91.1 million acres of corn, and we are actually lighter than the overall trade estimates heading into March 31.”

Overall, the 2022 Spring Planting Report by FBN shows farmers intend to plant fewer corn acres than what USDA projected in its 2022 Ag Outlook Forum, as well as what farmers ultimately planted in 2021.

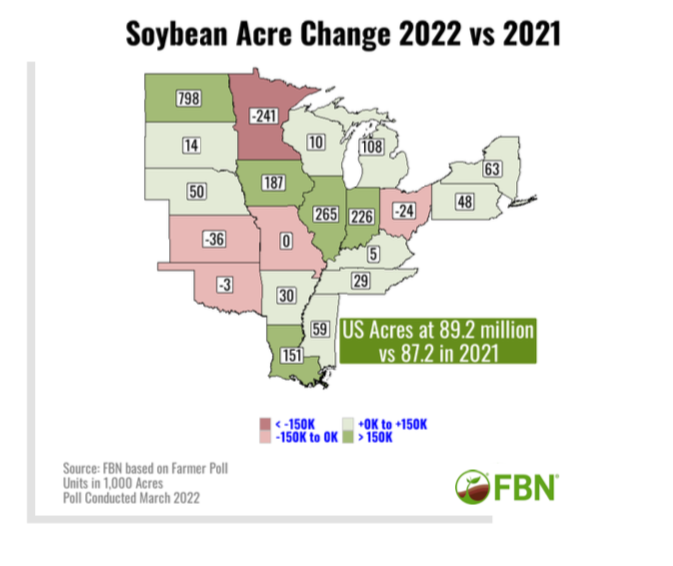

Soybean acres came in at 89.2 million, up from the 87.2 million acres in 2021. Sorghum lost 300,000 acres compared to 2021, with an estimate of 7 million sorghum acres in 2022. And cotton, which is seeing futures prices at the highest point since 2011, gained more than 1 million acres, with FBN’s survey pointing to 12.4 million acres in 2022.

However, wheat seemed to be another big finding in the report, as FBN found non-durum spring wheat acreage to hit 11.2 million acres, down from the 11.7 million forecast by USDA in February. It’s also down from the 11.4 million acres farmers planted last year. The survey showed durum wheat acres will come in at 1.8 million, which is higher than the 1.6 million farmers planted last year.

“I think the other big takeaway that we found surprising was farmers in the Northern Plains, the upper Midwest, are less willing to go into spring wheat than what the overall trade was expecting,” adds McNew. “In Montana, in the eastern part of North Dakota, farmers have other options like pulses and barley, which are less fertilizer intensive. And so we saw farmers in those regions say they were going to scale back spring wheat acres. So, our spring wheat acres estimate at 11.2 million acres is quite a bit below where the overall trade is at 11.8. And I think that's very inflationary for the wheat market that's already on edge because of what's going on in Eastern Europe.”

While the survey didn’t ask what’s driving farmers’ planting plans, McNew says previous FBN surveys show fertilizer prices are having an impact, and he thinks that could ultimately be a weight on the national average yield this year for crops like corn.

“We have seen quite a bit of indication from farmers that they're going to either be pulling back in terms of normal application rates, or they're going to start to try and use alternative nutrients like livestock manure,” says McNew. “We know livestock manure can have benefits and can be beneficial. But it's also extremely variable in terms of its nutrient value. You don't always know what you're going to get. And so it just requires a lot more work. So, our take on it is that not only is there kind of the acreage decision that's in play here, but I also think there may be a little bit of a yield drag this year when we talk about corn, because I don't think the fertilizer nutrients will be applied like they have in the past.”

State-by-state, FBN’s survey found many farmers in the Midwest pulling back on corn, with states like Kansas, Oklahoma and Arkansas actually seeing a slight boost in corn acres. Meanwhile, soybeans could see an increase in planting in nearly every state except Minnesota, Missouri, Kansas, Oklahoma and Ohio.

In 2021, FBN’s planting survey was spot on with the soybean acreage number. While the trade had been expecting 90 million acres of soybeans, FBN’s survey found 87.6 million acres of soybeans, which was ultimately what USDA also released in its March Prospective Plantings report. McNew says the one thing FBN has on its side is a large sample size.

"I can tell you that to do this well, you really need what statisticians call a representative sample. And that means a lot of farmers,” he says. “Think about the differences between a farmer in North Dakota and a farmer in Nebraska. Even within the state of Nebraska, you have different economics in western Nebraska versus eastern Nebraska. And so, to truly get a representative sample, you need a large survey. And we're very fortunate in FBN. We have over 30,000 farmers in the U.S., that entrust us with data, and that's one of our core missions.”

As an economist, McNew says based on the FBN planting survey results combined with the current supply and demand picture, he’s bullish on corn and wheat. While he still sees favorable factors for soybeans, his market view is neutral.

“There's always the wildcard that USDA report could show something really unexpected like bigger acres across the board,” says McNew. “I don't see that coming. We don't see it in our numbers from farmers. But barring that, if we're just talking about really shifting minor amounts, I don't see anything that really derails this market. We are in such a big demand surge, as a result of crop losses in South America, as a result of the Eastern Europe conflict, I think every acre matters this year. As we're tinkering at the margin here in the U.S., I don't think that's going to impact the overall price trends.”