Food Inflation To Return to Pre-COVID Levels

Food Inflation Update 051023

In a recent report from Wells Fargo, chief ag economist Michael Swanson says the data is trending toward 0% to 4% food inflation by 2024.

“The consumer is going to be very happy– if the consumer is ever happy sometimes as there are perpetual grumblers–because they are going to see much lower food inflation,” Swanson says. “That doesn't come without stress to the industry because food manufacturers and retailers still deal with trailing expenses.”

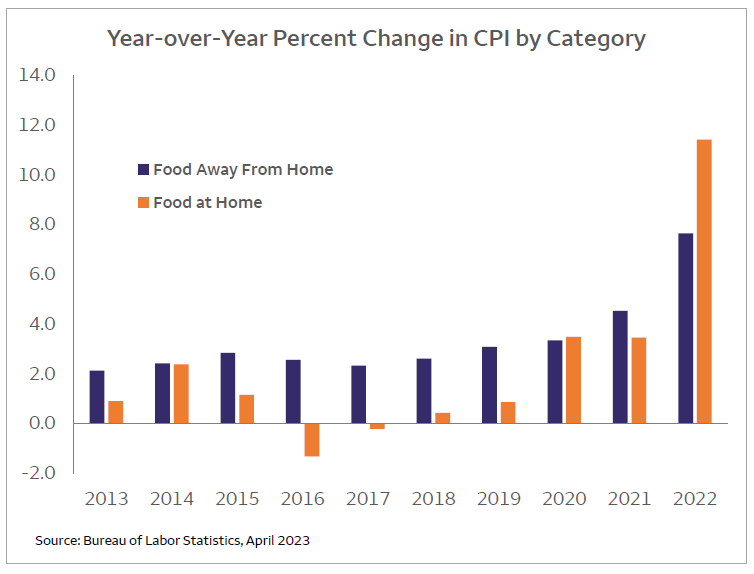

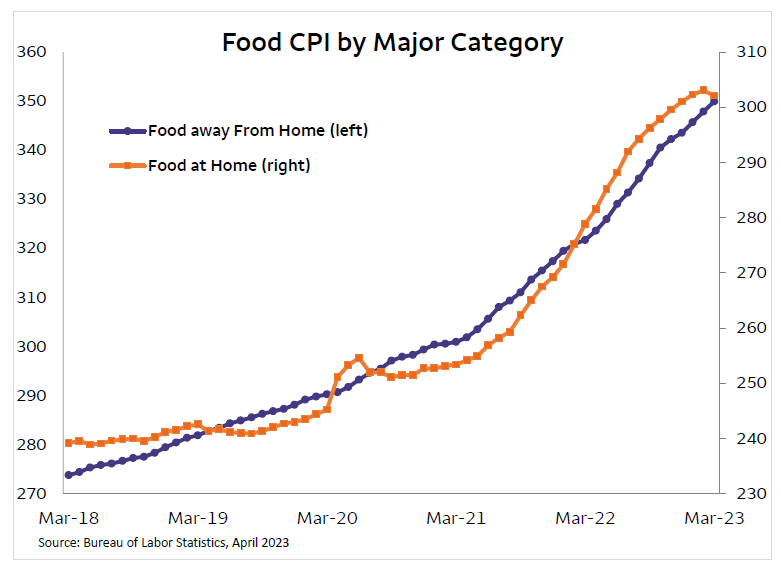

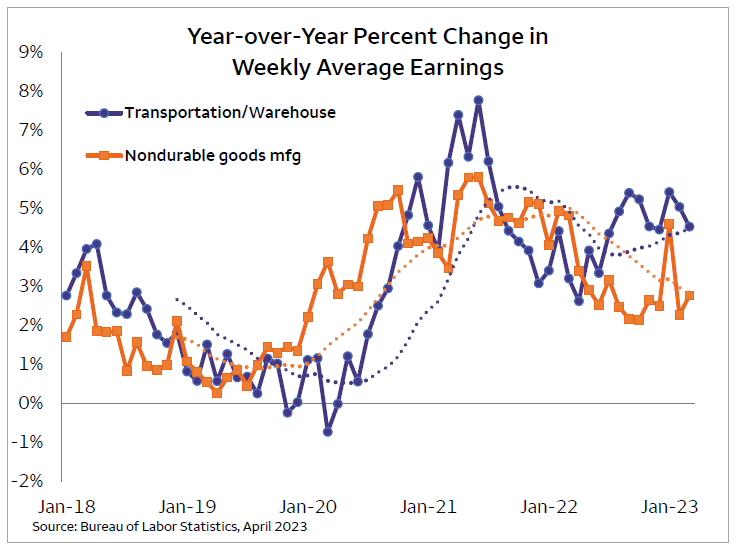

Swanson says we’ve likely seen the peak for food inflation last summer. What drove the up to 14% year-over-year food inflation since the COVID pandemic has been four key factors: transportation, labor, shipping and packaging.

“What we saw for food inflation, it wasn't a lack of ingredients. The American farmer really didn't miss a beat,” Swanson said. “We had a little bit of a shock and dismay around the Russian invasion of Ukraine and what that was going to do to the world's supply of grains and oil seeds but at no point were we really short ingredients. We were short the transportation, the labor, the shipping the packaging, and that's been what's driven the trends at this point.”

To illustrate how labor is the No. 1 factor in food costs, particularly for food eaten away from home, he highlights the difference in the food dollar spent and what percent goes to the farm gate level.

“It's actually quite shocking. If you buy food at the supermarket, USDA data say only about 12 to 15% of what you spend in the supermarket represents farm level contribution. So almost 90 cents of the dollar is somewhere else. When you go to the restaurant, it's almost in the 3% range. So when you're buying food at the at the restaurant, literally almost nothing is going back to the farm level.”

What else are the economists watching?

The Bureau of Labor Statistics released its April payroll report showing wage growth slowing to pre-COVID.

“It’s not going down as much it’s going sideways,” Swanson says. “And since it’s going sideways and not up, that makes a big difference in the outlook.”

The pace at which food inflation decreases is still a bit cloudy. Swanson is watching retail meat prices, and for example, month over month pork and poultry prices have decreased. He also notes dairy prices are coming down.

“Some of the big tickets are actually coming down. As we get towards the end of 2023 I would not be surprised to see food inflation running in the zero to 4% range,” he says.

The recent trends with food inflation may follow a pattern seen in recent history.

“Here's a really surprising outlook: If things continue to trend like we see on corn soybean prices as we go into 2024 we might actually see retrenchment in overall food inflation. We saw that back in 2014 and 2015 as they came off the high spike of corn and soybean prices of 2012 and 2013,” Swanson says. “So this is a market that can be very, very difficult for the food suppliers because they can actually go negative at the retail level.”

One segment to watch is edible oils.

“Whatever happens in the edible oil complex impacts the soybean meal complex which impacts the corn/soybean planting rotations. There's just no escaping that dynamic. When you think about edible oils, the renewable biodiesel initiative off the off the west coast enters the food/fuel dynamic that we were used to back during the ethanol buildout and edible oils had just extraordinary increase in expense. We went from a 25 cent per pound soybean oil to a 65 cent per pound soybean oil,” Swanson says.

He details edible oils go into baking, cooking, food service, pet food and more.

“One of the biggest open questions is what's going to happen with the growth around renewable biodiesel initiative and does it move into the aviation space. And I guarantee you depending on what you're betting and where you're betting it, there's a lot of very intense conversations about should I put $300 million into a bean crushing facility somewhere.”

And edible oils stands out as a segment driven by food demand, which is stable and predictable, as well as the emerging renewable fuels demand.