Employers Qualify for Tax Credit to Offset COVID-19 Paid Time Off

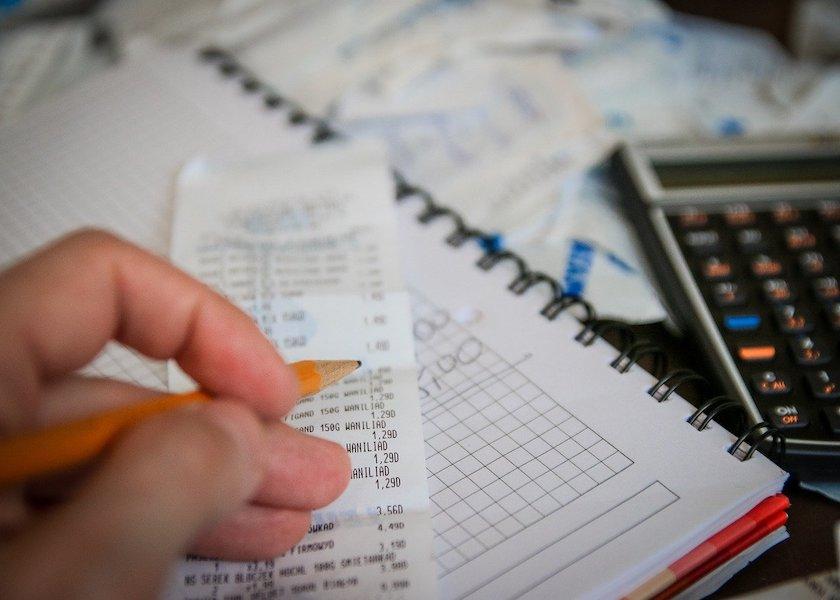

At this point in the pandemic, most employers have received a phone call that goes something like this. “Hi Boss, I was exposed to COVID-19. Do you want me to come in?” And in that moment, you run through 14,000 questions in your mind. Can we cover his or her schedule? Who had this person worked with before they knew they had been exposed? Can we afford to pay them for time spent at home? While those thoughts are going through your mind, your employee is worried about getting paid for required time off.

The Families First Coronavirus Response Act (FFCRA) signed into law on March 18, 2020 provides that eligible employees are entitled to paid sick time because of COVID-19, and employers are eligible for a tax credit to offset the expense.

Who qualifies as an eligible employee, how much time do they get and at what rate? Under the FFCRA, employees are entitled to:

a. Up to 80 hours of paid sick leave at the employee’s regular rate of pay (up to a maximum of $511 per day) where the employee is unable to work because the employee is quarantined pursuant to government order, is advised by a health care provider to self-quarantine and/or experiencing COVID-19 symptoms and seeking a medical diagnosis; or

b. Up to 80 hours of paid sick leave at two-thirds the employee’s regular rate of pay (up to a maximum of $200 per day) because the employee must care for an individual subject to quarantine (pursuant to government order or advice of a health care provider), or to care for a child (under 18 years of age) whose school or child care provider is closed or unavailable for reasons related to COVID-19.

What is the tax credit for employers? The FFCRA provides eligible employers with payroll tax credits to cover 100% of the qualified sick leave wages and qualified family leave wages paid from April 1, 2020, through December 31, 2020.

The FFCRA payroll tax credit includes:

1) Qualified sick leave wages;

2) Qualified family wages;

3) Qualified health plan expenses; and

4) Medicare tax credit.

According to an advisory from tax accountancy CliftonLarsonAllen (CLA), qualified sick leave wages are wages an eligible employer is required to pay under FFCRA for paid sick leave. Qualified family leave wages are wages an eligible employer is required to pay under FFCRA for expanded family and medical leave.

The tax credits can be claimed three ways:

1. On the Form 941, Employer’s QUARTERLY Federal Tax Return;

2. Offsetting Federal employment tax deposits for the quarter (the employer must account for the reduction in deposits on the Form 941 for the quarter); or

3. Filing Form 7200, Advance Payment of Employer Credits Due to COVID-19.

CLA shares this example of how the claims process works.

Employer pays $15,000 in qualified sick leave wages and qualified family leave wages during the 3rd quarter of 2020. The employer is required to deposit $18,000 in Federal employment taxes (including taxes withheld from its employees) for the 3rd quarter of 2020. The employer may keep up to $15,000 of the $18,000 of taxes the employer was going to deposit but is required to deposit the remaining $3,000 on its required deposit date. The employer will account for the $15,000 when it files its Form 941 for the 3rd quarter of 2020.

For more information, including extended family and medical leave details included in the FFCRA contact your accountant.