Carbon Markets: A Low-Hanging Fruit or The Next Cash Crop?

Most voluntary carbon markets introduced to farmers so far have made their first tranche of payments.

Meanwhile, a handful of companies have used carbon markets to spin off new efforts for market opportunities with traceability, sustainability and the broader definition of regenerative agriculture (for example, Truterra’s approach and Bayer’s ForGround).

A low-hanging fruit or the next cash crop?

So, what does the future hold for carbon markets? Currently the industry is based on credits being tradable assets, so it is not yet a fully developed market, points out Alejandro Plastina, Iowa State University Extension economist.

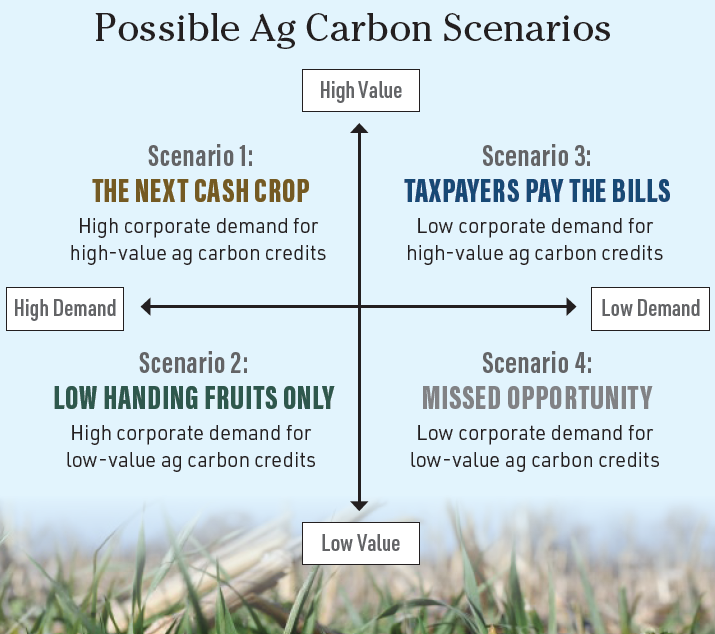

Looking into the crystal ball and applying economics, he sees four possible scenarios (see chart).

“The second scenario is most likely where we are heading,” Plastina says. “We want to get to the first scenario, but with the current status quo, we are moving toward the low-hanging fruit.”

As such, to foster a strong agriculture carbon market, he says these “science gaps” need to be addressed:

- Uncertainty in the projected volume of carbon credits that can be produced by a farmer depending on weather, timeliness of practice, etc.

- Measuring the volume of carbon removed or avoided by a farmer is difficult and costly, particularly at large scale, which is why the current method is just sampling.

- Carbon programs use different models, so it’s impossible to compare across programs the potential for carbon credit generation stemming from one change in practice on one farm.

How quickly can this market evolve? “A functioning market can be achieved in three to five years, if demand continues to be strong, and there’s more agreements on how to standardize the tools soon,” Plastina says.