Nebraska Farmland Values Jump 14% in 2023 — Up 30% in Two Years

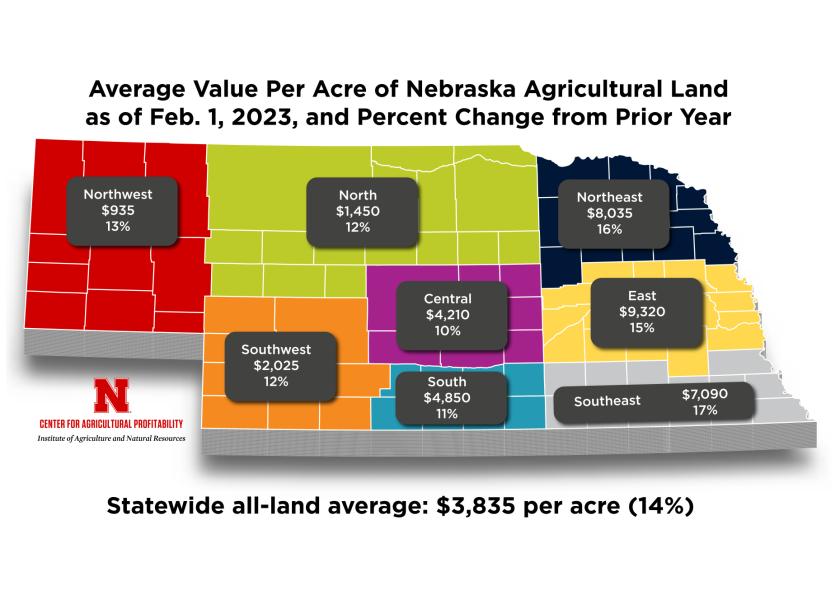

Farmland values in Nebraska are at historic levels. With a statewide average of $3,835 per acre, values are up 14% from 2022, according to the preliminary findings of the University of Nebraska–Lincoln’s 2023 Farm Real Estate Market Survey.

This double-digit jump is on top of the 16% increase in 2022. This year marks the second-largest increase in the market value of agricultural land in Nebraska since 2014 and the highest non-inflation-adjusted statewide land value in the 45-year history of the survey.

The survey attributes the rise in agricultural real estate values to higher commodity prices, purchases for operation expansion, favorable financial situations for current owners and an increase in buyers acquiring land as a hedge against inflation.

Low interest rates on loans in early 2022 and concerns about inflation fueled demand for investment in land, shared Jim Jansen, University of Nebraska Extension agricultural economist who co-authored the survey and report.

“Monetary policy in 2022 created a dynamic period as the Federal Reserve raised interest rates to combat inflation,” he says. “Interest expenses for land loans gradually rose over the prior year and into 2023 as the Federal Reserve continues policies to decrease inflation.”

The survey reports market values on several types of land across Nebraska. Here are the highlights:

- Dryland cropland with irrigation potential was up 16%.

- Dryland cropland without irrigation potential rose 13%.

- Center pivot-irrigated cropland rose 13%.

- Grazing land and hayland land rose 14% to 17%.

Rental Rates on the Rise

- Nebraska cash rental rates for dryland cropland rose 7% to 11% across the state.

- Pasture and cow-calf pair monthly rental rates rose 6% to 7%.

The Nebraska Farm Real Estate Market Survey is an annual survey of land professionals, including appraisers, farm and ranch managers and agricultural bankers. It is conducted by the Center for Agricultural Profitability, based in the Department of Agricultural Economics. Final results from the survey are expected to be published in June.