Global Grain Shuffle: Is The End Of U.S. Grain Export Dominance Near?

It didn’t start with the swing of an ax in the Amazon or by an explosion in Kiev. While both of those contributed, the shift happening in global grain flows is a multifaceted prism through which the picture of the future of grain delivery is continuing to evolve.

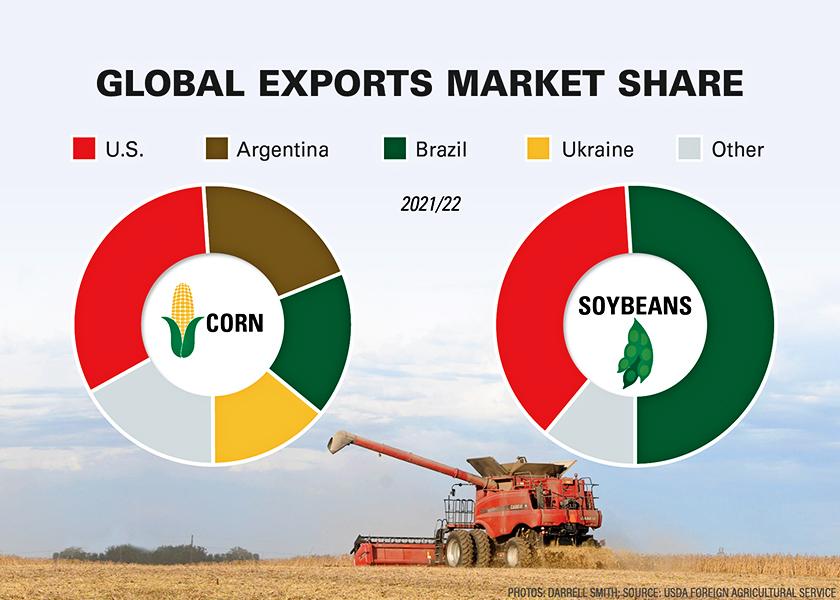

“This year, Brazil could take the crown of being the world’s largest corn exporter,” said Dan Basse, president of AgResource Company. “It took that crown for soybeans back in 2017.”

Global Acre Increase

This feat was set in motion by the U.S. drought in 2012 as higher prices encouraged more acres and pushed buyers to seek alternative supplies. While Ukraine has helped to fill some of that demand, the ongoing war and consequential infrastructure damage will make it hard for Ukraine to reclaim former volumes for some time.

“Ukraine, no matter what happens with the war from here forward, optimistically we’ll probably see corn and sunflower production 40% to 50% below normal,” Basse says. “The corn crop will probably be in the range of 18 million metric tons (MMT) or 20 MMT.”

Of course, that’s only possible if the negotiated shipping corridor remains open and transport vessels are willing to haul grain to its destination.

“It’s exceedingly unlikely Russia will pull out of this agreement simply because their allies, China, India and Iran, have a strong interest in keeping feed grains flowing,” says Matt Roberts, senior grain analyst with Terrain.

All Eyes on Wheat

As Ukraine’s production sputters amid war, labor shortages, high fertilizer prices and diesel near $30 per gallon, other countries will help make up the shortfall. Wheat will come from the EU, Argentina, the U.S. and Russia.

“The Russian wheat crop is a record over 100 MMT, and they’ll be exporting wheat at a cheaper price than us,” says Steve Freed, vice president of grain research at ADM Investor Services.

“If Russia has a crop problem, there will be a story in the world wheat market,” Basse adds.

Expanding acreage beyond U.S. borders, Freed and Basse agree, will continue to drive up supplies and drive down U.S. export demand.

“We think Russia could easily add 18 million acres for next year and Brazil could also add 18 million acres next year and not really affect the Amazon,” Freed says. “While environmentalists in Washington wants to add 3 to 4 million acres to the CRP.”

Soybean Spotlight

The juxtaposition of potential acreage contraction leveled against a new demand driver in renewable diesel and sustainable aviation fuel has expanding crush plants searching for more soybean acres, not less.

“The Renewable Volume Obligation (RVO) RVO came down from EPA in December and so we now think we’ll need somewhere between 14 million or 15 million additional soybean acres by 2026,” Basse says. “As we look at the last half of the year, we think soybean oil will make new all-time highs.”

As soybean oil prices and demand drives higher, Basse expects it to impact planting decisions in 2024. The result will be a burgeoning domestic market for soybeans and big exportable supplies of soybean meal.

“As renewable diesel comes online, our share in world soybean trade is declining,” Basse says. “This year, our share is only about 11% and when I first got in this business 44 years ago it was 64%.”

Freed agrees, expecting the trend to be lower U.S. grain exports due to a record crop in Brazil. That big potential matches the big demand from the world’s No. 1 soybean buyer, China. Roberts says we’ll still sell China soybeans, it will just come in the form of livestock protein.

“As China, India, Indonesia and other developing countries become wealthier it’s not just about eating more,” said Roberts. “It’s about eating better and that means moving up to better cuts of meat and animal protein.”

These analysts predict, the only constant in today’s global grain flow picture is change.

“The 2022 rally was all about lower supplies,” Freed says. “2023 is going to be about lower demand as prices try to compete with the fact that all these other origins are now cheaper than us.”