Future Shock: U.S. Agriculture Sleeping on China’s Historic Population Crash

American agriculture silently is watching the greatest disappearing act in world history. China, the biggest food importer on the planet, is entering the real-time throes of a potentially devastating population crash and the effect could be immense for U.S. farmers.

China has broken every branch on its family tree without need of war, cataclysm, or disease via 40 years of adherence to a self-imposed one-child policy. According to multiple estimates, China’s populace may dwindle from the current 1.3-1.4 billion to 1 billion by 2050 and a near unthinkable 494 million by 2100.

If China’s population is halved or diminished by a significant portion, the repercussions on U.S. agriculture exports could be massive. “This is going to happen—and happen faster than most people think; it’s happening right now,” says Todd Thurman, international swine management consultant and owner of SwineTex Consulting Services. “China’s population decline is not theoretical or even controversial—it’s only a question about the time frame and the degree of loss.”

American ag is asleep at the wheel, Thurman contends. “China—our biggest ag commodity buyer at present and the biggest in history—is on track for a population collapse like nothing the planet has ever seen, but hardly anyone in U.S. agriculture is taking notice.”

What happens if graying China, possibly the fastest aging country on the globe, needs more coffins than cradles, and declines by half in number? Answer: U.S. agriculture loses a hefty portion of its juggernaut customer base—not to a bang, but a whimper.

Good, Bad, or Ugly

Every day, China must feed 20% of global population. China is not only the world’s biggest consumer of agriculture goods—it is the biggest in history.

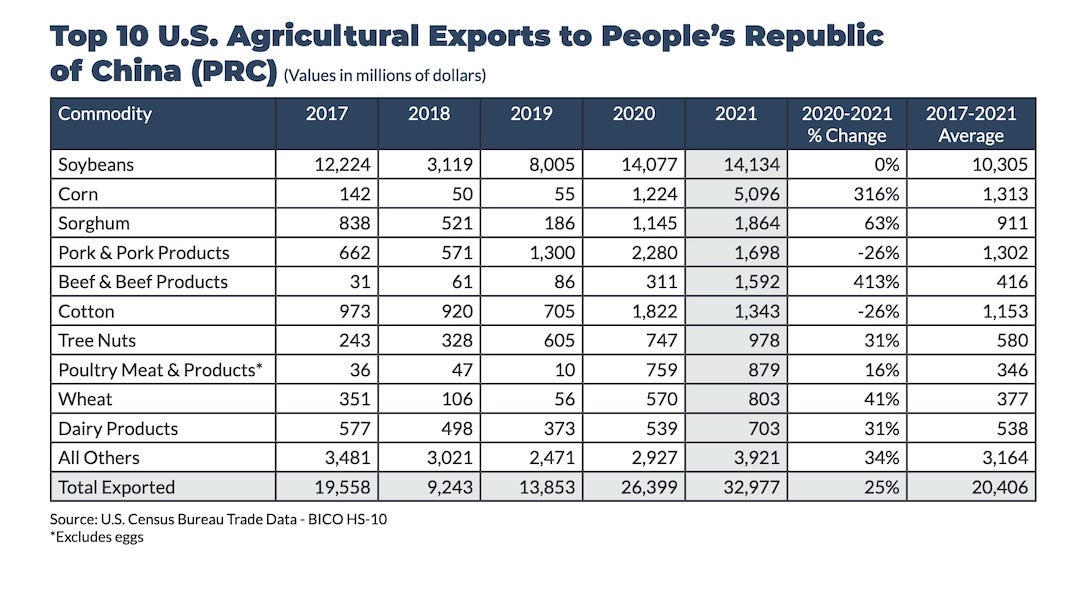

In 2020, the Chinese Communist Party (CCP) bought $193.5 billion in agriculture imports, including $26 billion from the U.S., making China the No. 1 buyer of goods from American farmers. In 2021, China’s ag imports increased, according to USDA/FAS’ 2021 Export Yearbook: “U.S. agricultural exports to China totaled $33 billion, up 25 percent from 2020. China was the largest market for U.S. agricultural exports and the largest food import market in the world. While Brazil remained the top supplier of agricultural goods to China with 22% market share, the United States was able to expand its market share from 14% in 2020 to 18% in 2021…”

What commodities are most coveted by China? In 2021, soybeans were king, valued at $14.1 billion as the No. 1 U.S. ag commodity sold to China. Corn ($5.1B), sorghum ($1.8B), pork ($1.7B), beef ($1.6B), cotton ($1.3B), tree nuts ($978M), poultry ($879M), wheat ($803M), and dairy ($703M) rounded out the top 10 U.S. ag commodities imported by China.

Good, bad, or ugly, China plays a colossal role in American agriculture. “It’s shocking,” says Thurman. “China’s role in our exports is a stunner.”

“Look at our top 10 ag exports in 2021,” he continues, “China is the No.1 destination for all of the top five commodity classes. They are No. 1 in six of the top 10 commodities, and in the four classes where they aren’t No. 1, they are still No. 2 or No. 3. It’s hard to understate how dependent we’ve become on China in terms of ag exports.”

“If something significant happens to China’s population,” Thurman adds, “and it will one way or another, the effect will be felt by almost every corner of U.S. agriculture.”

Close the Kindergartens

In 1970s, China sold the permanent on the altar of the temporary.

Nearing the 1-billion citizen benchmark in 1979 (China surpassed 1 billion in 1981), and convinced overpopulation would be its downfall, the CCP went ultra-draconian, reacting to surging population numbers by mandating a nationwide one-child policy. Backed by forced abortions, sex-selective abortions, sterilizations, and harsh fines, China prevented at least 400 million births, according to The People’s Daily, a CCP-controlled publication.

A 2.1 fertility rate is required to maintain a stable populace for any country. Two children replace two parents (along with a slight .1 bump to account for deaths during infancy or childhood). When two become one, demography is turned on its head—the kindergartens shutter. By imposing a one-child diktat across an almost 40-year stretch, China decimated its future population growth.

In tandem with population loss, China quickly is going gray. By 2030, 360 million Chinese—a quarter of the country and more people than the entire citizenry of the U.S.—will be older than 60. In 1978, prior to the one-child policy, China’s median age was 21.5. In 2021, the median age was 38.4, and by 2050, the median age could be over 50.

In 2016, aware of the lead balloon set to drop, the CCP announced a two-child policy. No gain. Five years later, in 2016, the CCP again tried to reverse population decline by jumpstarting a three-child policy. No gain. China’s 1.3 birthrate since 2020 is too little, too late.

Even if China experienced a massive baby boom (unlikely as all relevant trends point the other direction), the population will still decline in the near to medium term. The population die is cast.

Crash in the Cards

Plainly stated, China can’t unring the demographic bell. The UN’s World Population Prospects 2022 (WPP) report predicts India will overtake China in 2023 as the most populous nation. Further, the WPP report contains dismal population prospects for China by 2100. Best outlook, China drops by 20%. Base outlook, China drops by less than 50%—771 million. And worst outlook? China declines by over 60% to 494 million.

“In just 80 years, the UN estimates there will be 1.14 billion to 494 million Chinese,” Thurman details. “The UN projects a decline between 200 million to 1 billion. The more I dig in, the more I think the decline will be closer to a worst-case scenario. U.S. agriculture needs to think about what a shocking global export issue this could be. In simple terms, it means two-thirds of your top customer leaves the building.”

Adding layers to the cake, China’s true population numbers could be more alarming than UN projections. In 2007, Yi Fuxian, a scientist at the University of Wisconsin, published Big Country with an Empty Nest (banned by the CCP), accusing the CCP of playing hide-and-seek with demographic data, and presciently predicting China’s population would begin a slide in 2017—not in 2033-34, as stated by the UN.

In July 2022, the demographic records of 1 billion-plus citizens leaked in China, resulting in an online hacker release of a small portion of the data. Fuxian analyzed the numbers and sounded the alarm:

“It suggests that post-1990 births continued to decline faster than I had predicted, and in fact did not peak in 2004 or 2011. That means China’s real population is not 1.41 billion (the official figure) and could be even smaller than my own estimate of 1.28 billion. It also means that China’s economic, social, foreign, and defense policies—as well as those of the United States and other countries toward China—are based on erroneous demographic data.” (emphasis added)

Echoing Fuxian and speaking at the 54th Annual ECC PerspECCtive Conference in 2022, geopolitical strategist and author of The End of the World is Just the Beginning: Mapping the Collapse of Globalization, Peter Zeihan, says China is on track for a seismic reckoning.

“The Chinese have been updating their data in the last couple of years. They still haven’t released their 2020 census because they couldn’t believe what came back,” Ziehan noted. “They’re now starting to believe it and they now think they overcounted their population in excess of 100 million people, all of whom were born since the one-child policy was adopted … If this is true, China is the fastest aging society in human history. That means from a demographic point of view, the Chinese economic model cannot survive the decade. And it strongly suggests that as soon as 2050, the Chinese may have lost 600 million people.”

Despite possible upheaval for the world’s No. 1 importer of food, U.S. agriculture is not paying attention, Thurman says. He points to a trio of baselines for American farming to consider: “There are three factors that are not contentious or disputed. One, China’s population is going to be smaller in 2100 than it is now. Two, China’s population has either peaked, is peaking, or will soon peak. Three, China’s population is aging at the fastest rate in human history and they can’t stop the slide.”

A crash is in the cards.

Prison of the Present

As with any business, agriculture often is blinded by the glare of the moment, i.e., China is the eternal export darling. However, a quick peak backward is a reasonable look forward. Rewinding the clock in 20-year increments reveals the top importers of U.S. ag commodities in steady flux, with Japan dominating the No. 1 slot from roughly 1960 to 2000.

Therefore, who will be the belle of the ag export ball in 2040? 2060? 2080? “To say that our list of major export customers is not going to shift around should not be controversial, because that perspective matches history—and reality,” Thurman says. “We get blinded by the fallacy of the present. If you think things won’t be completely different 30 years in the future, go back 30 years in past.”

The entire structure of modern agriculture, head to toe, is built on a tacit assumption: Tomorrow’s population will be bigger than today’s population. The assumption has held true—until now. The family tree is shrinking in almost every corner of the globe, with Africa as the exception.

Africa is the sole region projected to have robust population growth over the next 30 to 70 years, according to Pew Research Center. Up from its present 1.5 billion, Africa’s population is expected reach 4-plus billion by 2100, including five of the 10 most populous nations: Nigeria, D.R. Congo, Ethiopia, Tanzania, Egypt.

“At a minimum, the contrasting directions of China and Africa tell us there’s a significant shift coming in global ag and food markets,” Thurman notes. “We’re going to see a major market move from East Asia to Sub-Saharan Africa, but if we’re flippant, someone will beat us to the punch. You can’t turn your export boats to other countries on a dime. The global population is expected to peak around mid-century so exporters will have to find demand in a declining global market. The competition will be intense.”

Benchmarks on the horizon often are ignored simply because of distance, but such a perspective is costly for agriculture, Thurman insists. “It’s concerning to me that we are decades away from a population trend impact and we not only have no plan—we aren’t even having a conversation.”

“I’m an optimist and I’m confident in the U.S. ability to deal with change. But there is a problem if we can’t recognize change. At the absolute least, I want to raise awareness and get people talking about what this demographic and export change will look like.”

Thurman does not pull his punches. The China stakes, he insists, are mammoth. “There is no precedent. There is no historical reference point for the slow fade of an incredibly large number of people. The U.S. agriculture export industry should consider the ramifications now because change is already baked in the pie and the sooner we recognize it, the sooner we can develop strategies for the new reality and the less painful those adjustments will be.”

To read more stories from Chris Bennett (cbennett@farmjournal.com 662-592-1106) see:

Young Farmer uses YouTube and Video Games to Buy $1.8M Land

Cottonmouth Farmer: The Insane Tale of a Buck-Wild Scheme to Corner the Snake Venom Market

Tractorcade: How an Epic Convoy and Legendary Farmer Army Shook Washington, D.C.

Bagging the Tomato King: The Insane Hunt for Agriculture’s Wildest Con Man

While America Slept, China Stole the Farm

Bizarre Mystery of Mummified Coon Dog Solved After 40 Years

The Arrowhead whisperer: Stunning Indian Artifact Collection Found on Farmland

Where's the Beef: Con Artist Turns Texas Cattle Industry Into $100M Playground

Fleecing the Farm: How a Fake Crop Fueled a Bizarre $25 Million Ag Scam

Skeleton In the Walls: Mysterious Arkansas Farmhouse Hides Civil War History

US Farming Loses the King of Combines

Ghost in the House: A Forgotten American Farming Tragedy

Rat Hunting with the Dogs of War, Farming's Greatest Show on Legs

Evil Grain: The Wild Tale of History’s Biggest Crop Insurance Scam