Fundamental Outlook: The Farmland Market Should be Buffered from a Collapse

Midwestern farmland values appear to be leveling off after their spectacular surge from the last half of 2020 through the first half of 2022.

So what is ahead for farmland prices? Is it still safe to buy or is a major decline in values just ahead?

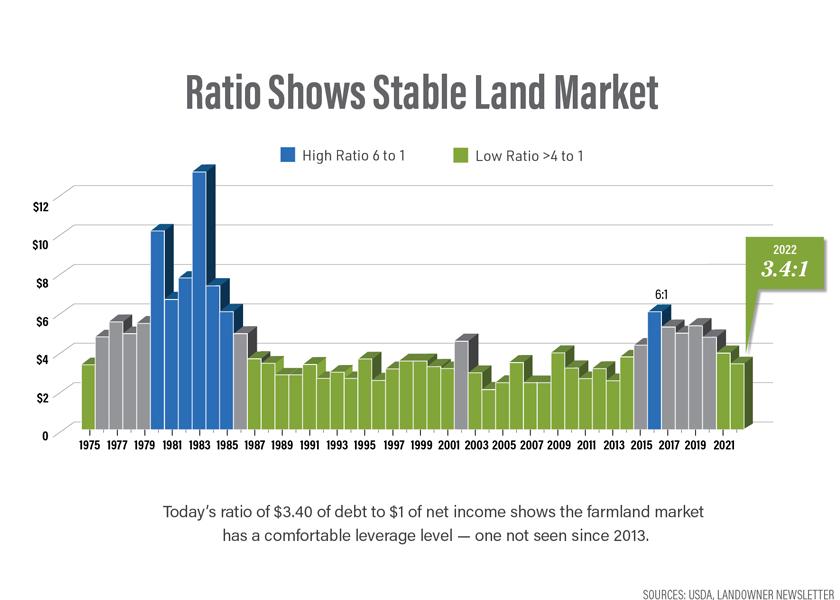

A key financial ratio we watch at LandOwner Newsletter suggests the financial health of the agriculture sector is still strong and not overly leveraged. This suggests the farmland market is not yet vulnerable to a 1980s-style liquidation.

LEVERAGE LEVELS

The indicator is the debt-to-income ratio. It reflects how much total net farm income, as forecast by USDA, is available to service total farm debt. A high ratio, such as $6 of debt to $1 of net income, means debt is too high and income too low. A low ratio, such as 4:1, means leverage is at a comfortable level.

A high ratio for three straight years is a signal that without a boost in income or a decrease in debt, farmland foreclosures could occur soon. If the amount of such foreclosures exceeds market demand, a downturn in land prices would result.

The ratio hit 6:1 in 2016 as debt increased and farm income fell, which gave us pause on the farmland value outlook in 2017 and 2018. But incomes improved, and the ratio dropped.

The ratio eased in 2020 due to high commodity prices and COVID-19 funds funneled into farmers’ hands.

The prosperity in 2021 eased the ratio to 3.9:1. The revised net income forecast from USDA in September suggests a ratio of under 3.4 in 2022, meaning no imminent liquidation danger is apparent.

LOW DANGER ZONE

A low ratio suggests while net incomes have surged, farmers and their lenders have been conservative in adding debt. This puts the industry in a stronger financial position versus the highly leveraged farm economy of the late 1970s. That was just ahead of the commodity price collapse and resulting ag recession of the 1980s.

It means the industry has lower leverage and can cope with several years of low commodity prices. This gives us confidence the farmland market is more buffered from a washout collapse like that in the 1980s.

For 45 years, Mike Walsten covered trends in the farmland market. Today, he serves as a contributor for LandOwner, since retiring from the role of editor.