The Farm CPA: Depreciation, Depreciation, Depreciation

The concept of depreciation is pretty simple. You purchase an asset and then deduct part of that cost each year until it is fully written off. But there is more to it, as farm depreciation comes in three flavors: tax, book and economic.

Tax: Tax depreciation is set by the tax code and includes several steps for each purchased asset. First, a farmer can elect to expense up to $1.02 million of qualifying assets using Section 179. If a farmer spends more than $2.55 million on qualifying assets, the maximum deduction is reduced dollar-for-dollar.

Second, a farmer can then take 100% bonus depreciation on all farm depreciable assets or elect to not take any bonus depreciation. It does not matter if the asset is new or used.

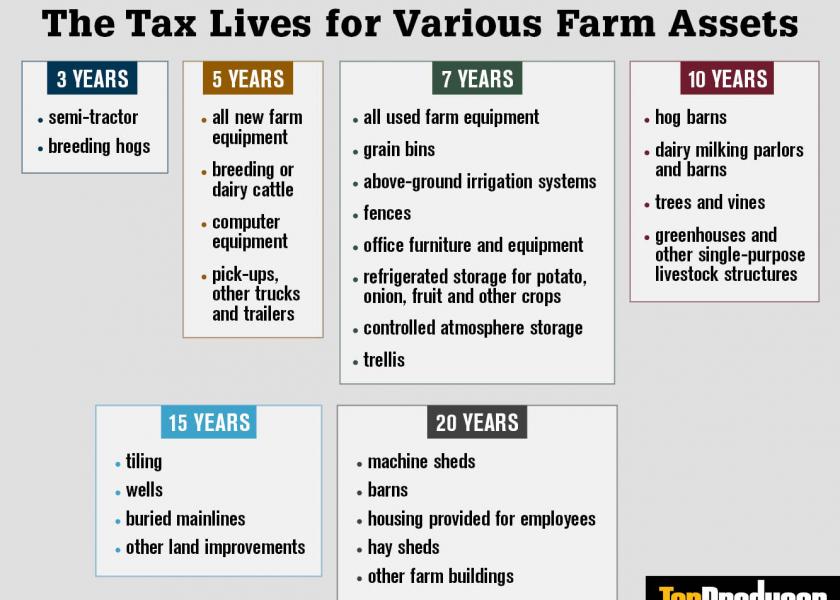

For example, a farmer builds a new shop, buys a used combine and a new tractor. These assets are depreciated over 20, seven and five years, respectively. The farmer can take 100% bonus on the shed (because it takes 20 years to write off) and elect not to take bonus on the machinery. Any remaining cost basis is depreciated over three to 20 years. This uses a double-declining method (faster in the first few years) and then a straight-line method.

Farmers try to use a depreciation method to match up the expense with the principal payments on the debt for buying the asset. Too many farmers simply try to deduct all of the asset up front without realizing extra taxable income is needed in future years to pay the principal.

Book: When preparing financial statements, book depreciation is used. This method tries to match up the life of the asset and then depreciate the asset down to an estimated salvage value. It typically uses the straight-line method; however, other methods can be used.

For example, you can depreciate a tractor using hours. If the cost of the tractor is $500,000 and it is expected to last for 10,000 hours, a farmer would deduct $50 per hour as depreciation.

Economic: Finally, farmers need to know the economic depreciation of an asset to determine its true net income or loss for the year. Some use a simple percentage of the assets. This could be 10% to 15% for each year. Others might get an equipment appraisal and take the difference between beginning and ending values to determine economic depreciation for that year.

A Comprehensive Look. Farmers really should determine each of these every year. Tax depreciation is needed to prepare tax returns, while book depreciation is needed to properly prepare a financial statement. Economic depreciation is needed to determine the real annual return for the farm.

Using tax depreciation overstates the deduction (or might understate with no new purchases). Book depreciation is usually not equal to economic, and both serve their purpose in managing the farm operation.

Paul Neiffer is a tax principal with CliftonLarsonAllen and author of the blog, The Farm CPA. He owns a farm in Washington.