Bill Biedermann: The World Needs Both North and South American Bin Busters

Is 2023 when the shoe drops? Or will it provide some of the same profitable grain marketing opportunities as 2021 and 2022? Questionable corn demand and expected production highs in South America bring major questions to the corn and soybean outlooks. Yet positive factors are evident. Top Producer asked eight analysts to provide their best estimates on price direction and market strategies you can employ this year. Here is one of the eight.

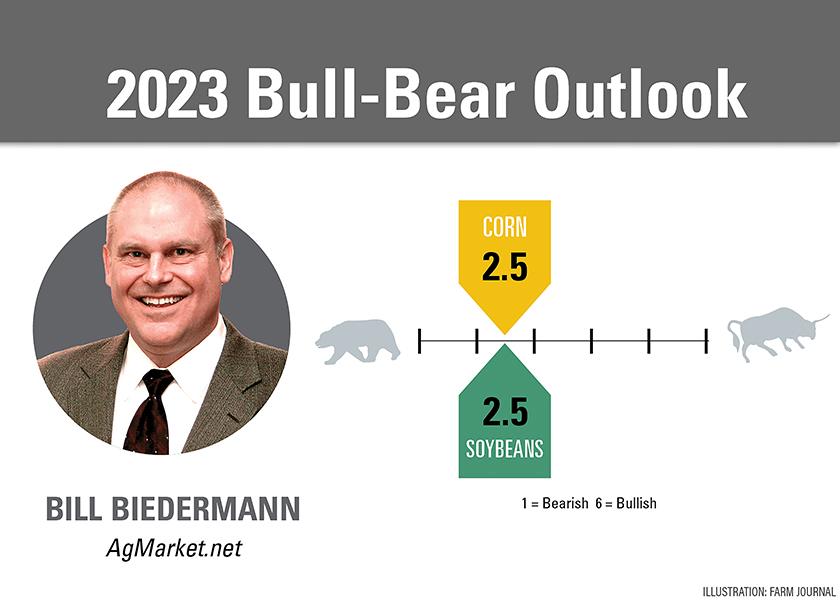

Bill Biedermann, AgMarket.net

To resolve the tight stocks situation, the market needs two strong production cycles. The South American cycle is off to a great start in Brazil with record acres and production estimates. Argentina was off to a great start based on acres, but drought has caused corn and soybean estimates to decline. Their combined production is still strong enough to temper a bullish reaction, but there is a lot of time until the end of their production cycle.

The second production cycle is, of course, the U.S. We anticipate similar acreage to 2021 (180 million acres of corn and soybeans). This will set the U.S. up for record crops if we get the right weather. Be aware, the stakes are high, and the world needs both North and South American bin busters to calm the nerves of buyers.

What if we get bin busters? First, large crops would relieve the pressure for buyers who are now paying record basis premiums.

It is also important to understand the most significant fundamental factor influencing your market: U.S. fiscal policy. Eventually layoffs will bring unemployment toward 4.5% to 5.5%, which will eventually be reflected in lower demand for gadgets. That lower demand will result in lower prices as inventories build.

Thus, the trend of the 2023/24 ag markets is clearly balancing on a tightrope of weather. This will dictate if the tight stocks are resolved and we trade deflationary policy, or if tight stocks become even more scarce and we see everyone bidding after every last kernel.

We are 50% price protected with a floor and a ceiling so our 2023 input costs are covered. If the market goes up, we still get a higher price on every bushel, and we still have 50% of the crop open. We have no delivery obligation, and we can sleep at night if good crops and deflation drive down values.

Read More

Mark Gold: Protect Profitable Prices with Put Options

Alan Brugler: Consider Grain Holding Costs and Set Price Floors

Matthew Kruse: Avoid Market Noise and Stay Focused on Price Targets

Naomi Blohm: Use Seasonal Grain Tendencies to Your Advantage This Winter

Disclaimer: This material has been prepared by a sales or trading employee or agent of these analysts and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions and agree that you are not, and will not, rely solely on this communication in making trading decisions. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that these analysts believe are reliable. Such information is not guaranteed to be accurate or complete, and it should not be relied upon as such. Trading advice reflects good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice provided will result in profitable trades.