2023 Corn and Soybean Market Outlook: Bulls Versus Bears

By Sara Schafer and Clinton Griffiths

Corn and soybean prices hit 10-year highs in 2022, creating exceptional returns to row crop producers. Will 2023 be a repeat or will prices shift lower? Stephen Nicholson, global analyst for grains and oilseeds at Rabobank; Dan Basse, president of AgResource Company; and Ben Brown, agricultural economist at the University of Missouri, dive into some of the bullish and bearish factors at play for the year.

Corn

BULLISH FACTORS

- Ethanol production (and demand for corn) has remained relatively stable, even after a slow demand period through summer 2022.

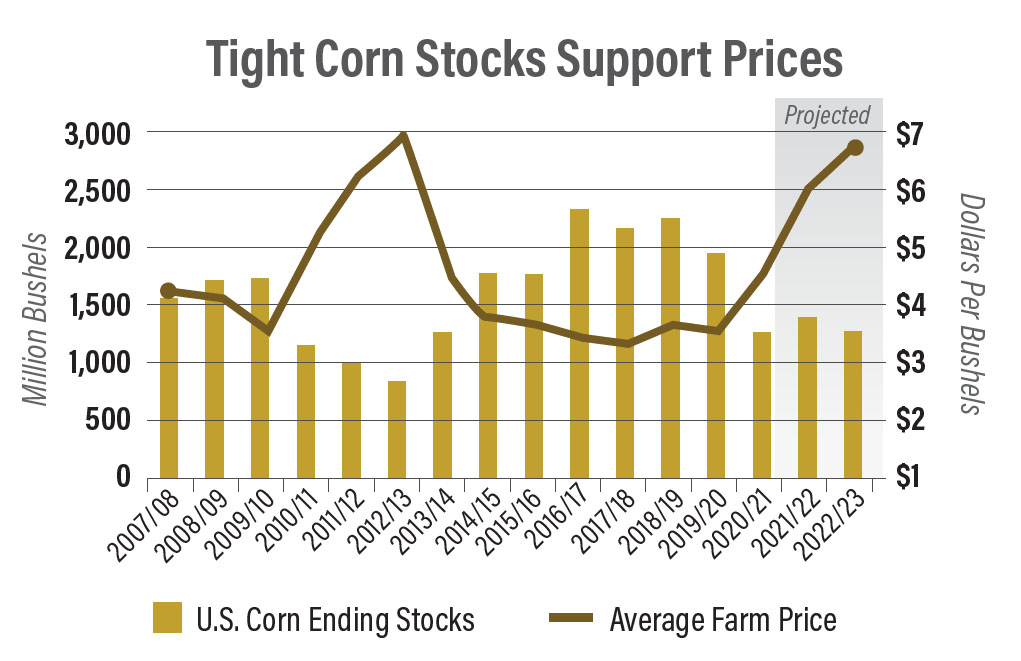

- Corn supplies for 2022/23 supplies are down 6% while total demand is projected to be down 5.7%. As a result, Nicholson says, in 2022/23 the ongoing tight stock situation will be supportive to prices.

BEARISH FACTORS

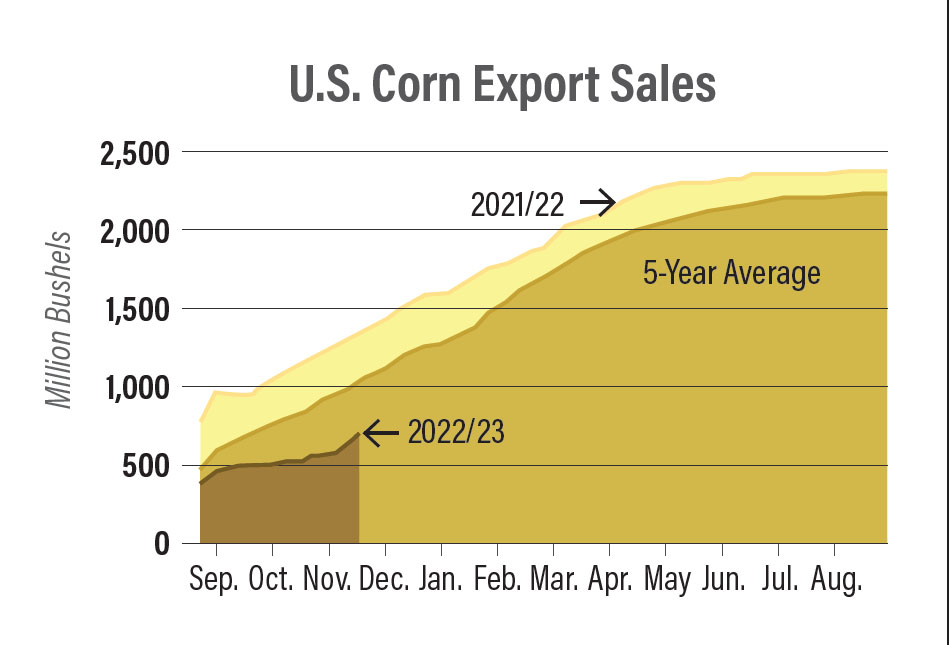

- U.S. corn exports for 2022/23 are 30% below last year’s pace. But, the key is timing, Nicholson says: “This is not our strong export time for corn; that time is coming in the next several months. Let’s not dig the grave and bury the corn market now because of these low exports.”

- Corn acres in the U.S. will likely top recent years, Brown says. “We will see an increase in corn acres in 2023, which is not something I would have said six months ago,” he says. “But the price premiums for other crops have eased.” In addition, Brazilian farmers will likely expand their safrinha (second crop) corn acres. Since their Brazilian soybean crop was planted in a timely fashion, the safrinha corn crop can follow suit.

WILD CARD

- Market analysts say the U.S. beef cowherd in 2023 could fall to the smallest number since 2014. That will reduce feed demand but maybe not in a major way, says Brown: “I’m expecting just a little feed demand destruction as the U.S. is really low on forage supplies in key areas, so demand for feed grains will stay relatively stable.”

Soybeans

BULLISH FACTORS

- Similar to corn, U.S. soybean stocks are tight, which will likely continue to support prices.

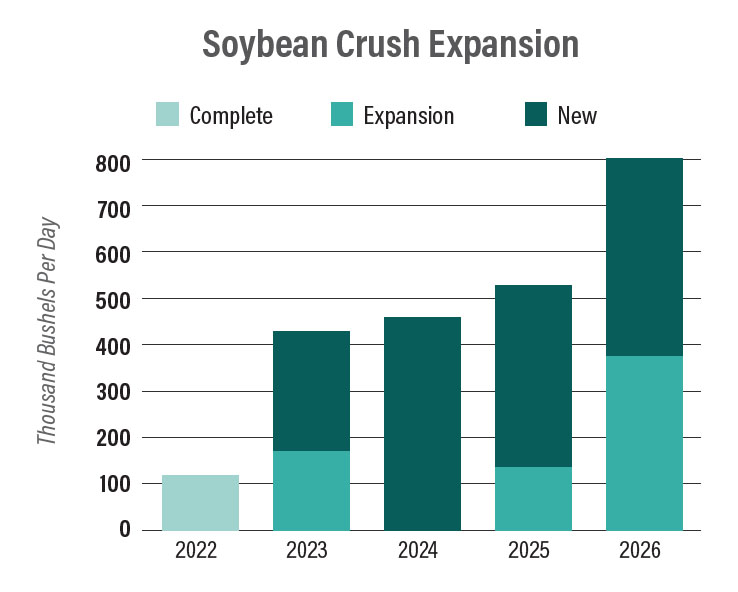

- Renewable diesel and sustainable aviation fuel are key demand drivers for soybeans, as domestic soybean processing capacity expands. To date, announcements have been made for 23 plant expansions, which would add 750 million bushels per year in crush capacity, according to Scott Gerlt, American Soybean Association chief economist. The announced 23 new or expanded crush plants would increase crush capacity by 34%.

“Never before have we had 23 new or upgraded crush facilities occurring at the same time, so, there’s bullish-ness in the background of this market,” Basse says.

Traditionally the U.S. soybean market has been focused on exports, primarily to China, but the growth in U.S. crush soybean facilities will change that philosophy and market infrastructure, Nicholson says.

“The domestic market will become as important or more important than exports,” he says. “Product demand seems insatiable, but we don’t have all the domestic infrastructure for soybeans, and we’ll have a surplus of soybean meal. What do you do with all that meal? This will all unfold in the next three or four years.”

BEARISH FACTORS

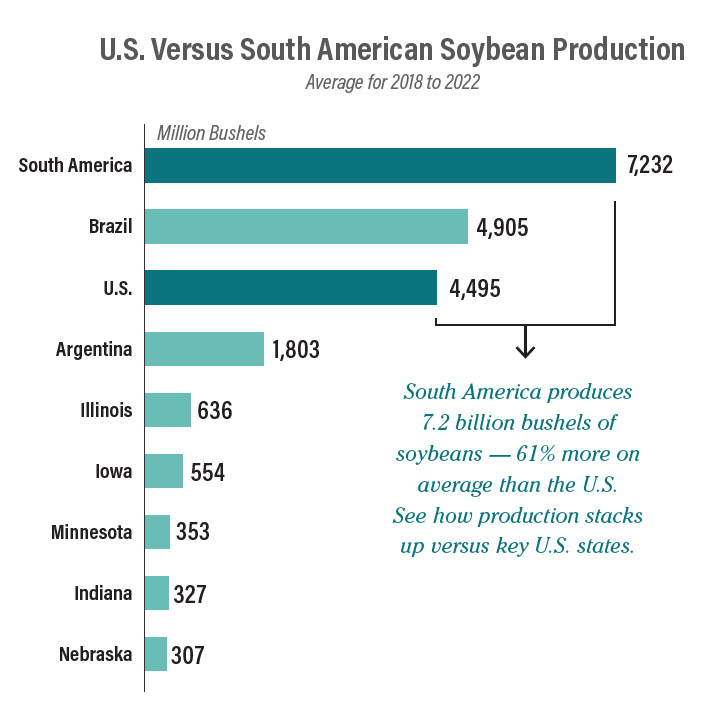

- Brazilian soybean acreage is expected to grow 3.5%, to 105 million acres this crop year, according to CONAB. It would be the first time the planted area will exceed 100 million acres. In addition, other South American countries are also increasing acres. Even with dry weather in Argentina, Nicholson says a record could be on tap.

- Keep an eye on Ukraine’s soybean production, adds Brown: “The expectation is they will focus on soybean production versus corn because it is a lower input cost.”

Read More: Soybean Harvest Is Just Beginning in Brazil. Here’s What the Crop Looks Like

WILD CARD

- U.S. exports of soybeans to China are down, Nicholson says, but signals are mixed on the big-picture impact. “Soy-bean export inspections are running 9.5% behind last year, while outstanding sales are up 28.6% versus a year ago, second-highest on record,” he says. “Therefore, exports may end the year on a high note.”

CATTLE MARKET FACTORS

The beef cow culling rate in 2022 was record high at 13%. Beef cow slaughter was 12% higher than 2021, which was 9% higher than 2020. John Nalivka, president of Sterling Marketing, projects U.S. cattle inventory early this year to be 89.08 million head, a decline of 3%. He estimates the number of feeder cattle outside of feedlots to decline 4% (or 1 million head) in 2023 versus 2022.

Despite tightening supplies, feedyard inventories have remained near capacity in the past three years. That will change with inventories expected to drop this year. Fewer cattle on feed will lead to a beef production drop. “Beef production will decline in 2023, but the magnitude is uncertain,” says Derrell Peel, Oklahoma State University livestock economist. “The smallest decline is expected in the range of 3% to 4%, but it could be as much as 7% to 8%. The difference will depend on cattle slaughter, which in turn, will depend on drought conditions.” ~Greg Henderson

Read More

2023 Grain Markets: 8 Analysts Share Price Direction and Market Strategies

Jerry Gulke: Soybean History Lesson Provides Clues to Future Price Direction