Could 2021 Net Farm Income Really Drop? Here's Why USDA’s First Forecast May Be Too Low

Farm Income Forecast 021221

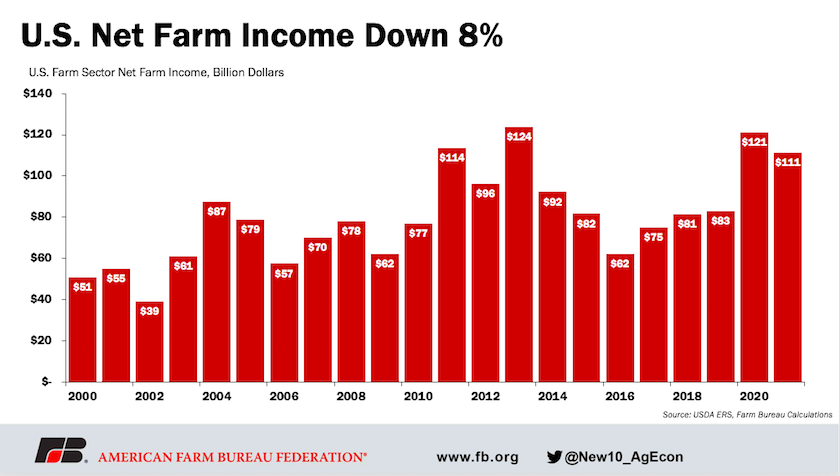

Friday marks one week since USDA released its first net farm income forecast this year. The initial look showed farm income could fall 8%, which would be a $10 billion drop from 2020.

However, the net farm income story this year is far from over. Much of USDA’s projected drop is counting on little to no government payments this year. And while a lot can still change in 2021, Farmer Mac’s chief economist says history shows USDA’s initial look at net farm income is typically too low.

“If you go back and you look at prior years of USDA forecasts, we find its on average about 13% too low,” says Jackson Takach with Farmer Mac.

University of Missouri economist Pat Westhoff says coming off a year where 40% of the net farm income picture was made up of government payments, the projected drop for 2021 isn't a surprise.

“For the most part it seemed to confirm what we were expecting to see,” says Westhoff, director of the University of Missouri Food and Agricultural Policy Research Institute (FAPRI).

Westhoff says even without government payments, the picture for 2021 shows improving commodity prices will help farm income this year.

“The very sharp drop in government payments does result in a modest decline there from 2021,” says Westhoff. “They [USDA] are projecting increased receipts for both crops and livestock. So, that's definitely encouraging.”

Takach thinks USDA’s projection has room to grow, especially considering commodity prices today versus what USDA has penciled in.

“If you look at the prices that were baked into the February forecast from the USDA, we're in the neighborhood of like a $3.60 corn price,” says Takach. “And we know that right now, the corn prices in the futures markets are up above $5. There's also that basis, and you have to account for basis, but it's not $1.40 in basis. So, it's very likely that some of the prices that are being captured by farmers in the first quarter and first half of the year, are going to put some upward pressure on expectations for the year.”

As commodity prices climb, so do feed costs, another expense that could impact the overall net farm income picture in 2021.

“Frankly, one area we think USDA is too low is on feed, where they have a modest increase in feed costs projected,” says Westhoff. “But given where corn and soybean oil prices are, it’s a little surprising they're not showing a larger increase than they are.”

As volatility continues to take shape in 2021, Takach still thinks the net farm income picture will improve.

“I do think that we'll see an upward revision coming through in in when we get to August,” says Takach. “The next look is not for another six months. So we have a long wait before we get another look from USDA. And that's when we might see our first upward revision if these commodity prices hold.”

Related Stories:

With Fewer Government Payments, USDA Forecasts Net Farm Income to Fall