Corn and Soybean Prices Soar Higher, Even With USDA's Surprising March Prospective Plantings Report

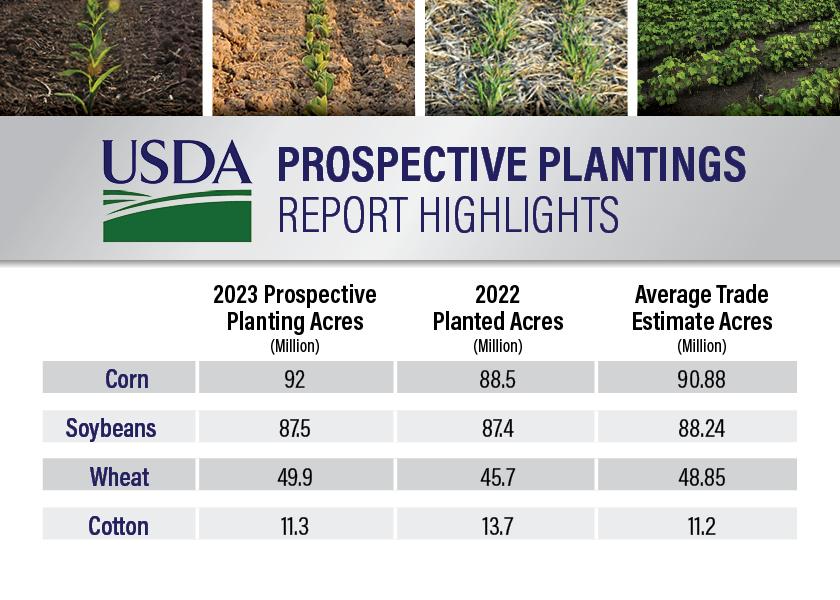

USDA says farmers intend to plant significantly more corn acres in 2023. That’s according to the 2023 Prospective Plantings report released on March 31. USDA shows farmers who were surveyed expect to plant nearly 92 million acres of corn, which is more than 1 million acres higher than pre-report estimates and a 3.42 million acre jump from last year. Combine the plantings report with some tighter-than-expected grain stocks, and USDA's reports sent commodity prices higher to end the week.

USDA’s March plantings report shows:

- Corn: 91.9 million, up 4% from 2022

- Soybeans: 87.51 million, up slightly from 2022

- All Wheat: 49.9 million, up 9% from 2022

- Cotton: 11.3 million, down 18% from 2022

Even though the projected corn plantings look like a big increase, Joe Vaclavik of Standard Grain says compared to previous years, the numbers weren't extremely out of line with expectations.

"For the trade to miss corn by 1 million, I mean, those sort of misses are to be expected in this sort of deal," Vaclavik says. "There have been years where the trade will miss corn acres by 3 million or more, and there have been years where the trade will miss corn stocks by 200 million or 300 million bushels."

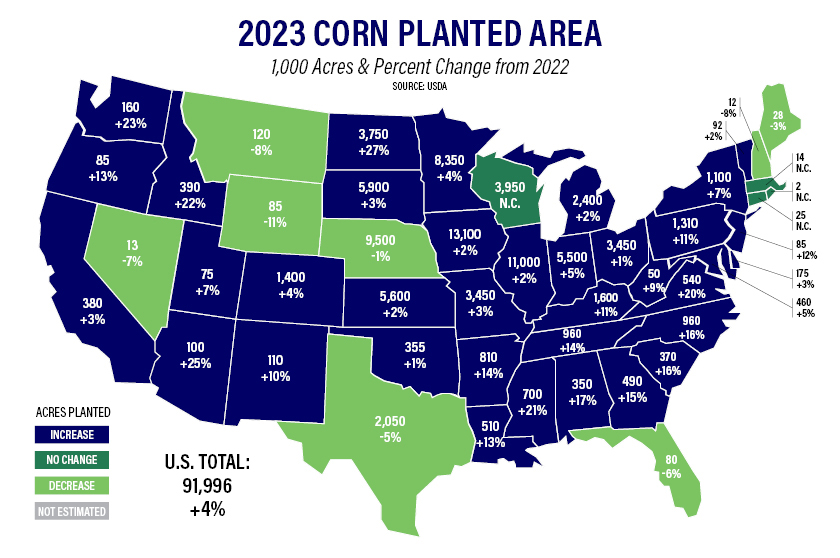

Peter Meyer of S&P Global Commodity Insights says the thing to watch is where farmers plan to plant more corn, especially in the northern tier of states that are facing historic snowfall and winter moisture, with another winter storm on the way.

"It's where the corn acres sit, 1.3 million acres in North Dakota, South Dakota and Minnesota, which from all indications, farmers will not be able to get into the field until mid-April when the temperature breaks," Meyer says. "They're looking at record snowpack, more cold temperatures coming. But USDA's report does makes sense, because economically speaking, farmers should be planting corn."

Ahead of the report, analysts were projecting farmers would plant more corn acres, as well as more soybean acres compared to last year’s USDA acreage numbers.

Overall, the average trade estimate ahead of the report was:

- Corn: 90.88 million

- Soybeans: 88.24 million

- Wheat: 48.85 million

- Cotton: 11.2 million

USDA projects 318.1 million acres of principle crops to be planted this year. That’s 6 million more acres than in 2022 and nearly 1 million more acres than farmers planted in 2021.

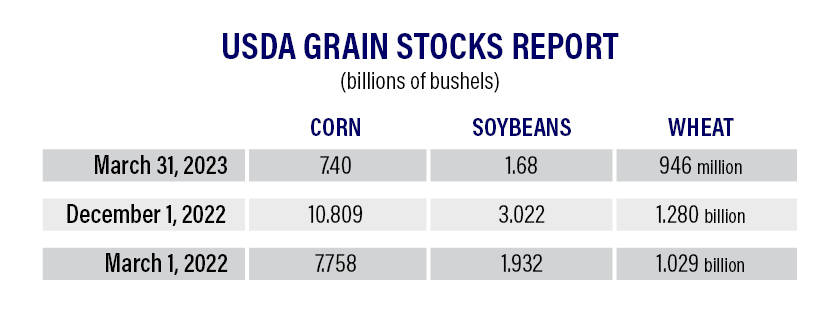

Tighter Grain Stocks Steal Headlines

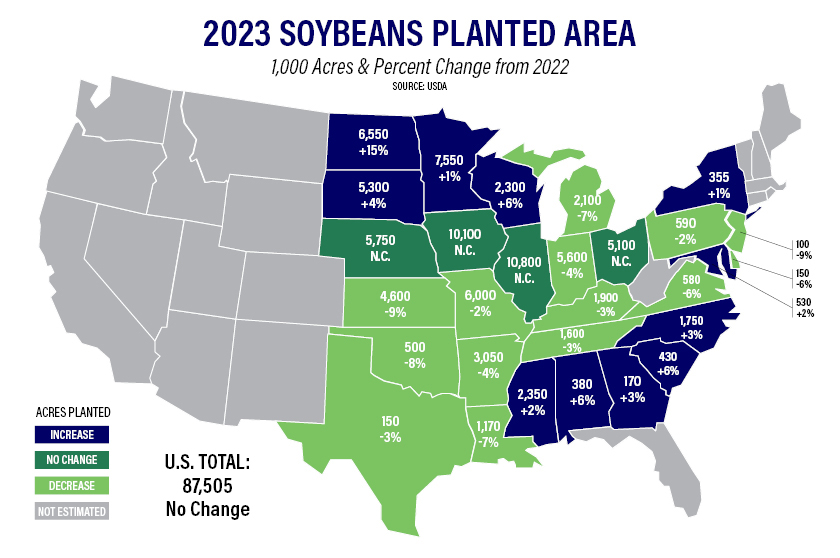

The March Grain Stocks Report seemed to be the one that grabbed the trade’s attention, with USDA revealing corn and soybean stocks tighter than expected as of March 1, 2023. When those adjustments are combined with the plantings report, analysts say soybean prices could see some excitement this year.

"I feel like there's a big divide in the corn situation versus the soybean situation," Vaclavik says. "If you take these acreage numbers, you plug them into the balance sheets, you mess around with the stocks and kind of plug in what's out there, I feel like the soybean balance sheet has the potential to get incredibly tight, and the corn situation has the potential to become incredibly loose. But again, that's assuming that these acreage numbers are correct."

Vaclavik says he agrees with Meyer in that the corn acreage number printed in the March plantings report could be the highest corn acreage number the market sees this year, especially with the risk of delayed and prevent plant acres in the north.

The Demand Wildcard

Other than weather, the biggest wildcard is China, a demand factor the trade will be watching. If their buying spree continues, Vaclavik says that could change more than just the old crop picture.

"I think there's some demand same things on the demand side of the balance sheet. How much more corn does China want to buy? When you start to look at the lower corn stocks number that USDA published today, pair the lower corn stocks number with the idea that USDA may now be understating corn exports if this China demand thing continues, you could be looking at a drastically lighter old crop," says Vaclavik.

"We [S&P Global Commodity Insights] agree 100% with Joe," adds Meyer. "If China keeps coming in here, you could have a problem with old crop. If China all of a sudden stops tomorrow, you could see the price sell off. But we're 100% with Joe on the demand side, China's the big gorilla in the room, so to speak."

Meyer says China could create a much tighter balance sheet. How much could China still buy? Meyer says that's anyone's guess.

"It could be 2 million, it could be 5 million, it could be 7 million, we're just really not sure," says Meyer. "But we do think that without this sell off that we saw in late February or early March, China would not have been in the market. China is a value buyer. And they bought the value. And they did a good job of that. But the question now is, will they come back?"

Watch more report reaction with AgriTalk's Chip Flory.

Related Stories:

Why is China Buying So Much U.S. Corn Right Now?

China Keeps Buying U.S. Corn, How Many More Purchases Could Still Be On the Way