Commodity Programs Might See a 12% Cut in the Proposed $1 Trillion Farm Bill

The Congressional Budget Office unveiled its 10-year cost estimates (2024 to 2033) for existing farm bill programs on Wednesday, with a projected $1.5 trillion price tag, up from $867 billion in the 2018 farm bill.

Jim Wiesemeyer, Pro Farmer policy analyst, advises not to put too much weight in these estimates, as they are the reason the farm bill is out of date so soon after it is written.

“CBO’s farm bill forecasts are frequently well off the mark in either direction,” he says. “It’s a lot like USDA’s farm income projections in February for the year head. CBO looks out 10 years … good luck taking these forecasts too seriously."

So, will this amount of money keep the programs ahead of their time? Some aren't convinced. And it starts with the farm bill's largest funded program—Supplemental Nutrition Assistance Program (SNAP).

SNAP Spending

Based on the 10-year period, SNAP spending is nearly 82% larger than what it was granted in the 2018 Farm Bill at $663 billion.

A large portion of the increase is due to the administration’s re-evaluation of SNAP’s the Thrifty Food Plan (TFP), which resulted in a quarter-trillion-dollar increase in SNAP benefits from July 2021 to the May 2022 baseline.

In the most recent baseline, CBO increased its estimate of outlays for SNAP by $93 billion over the 2023–2032 period for “technical” reasons.

According to Sen. Boozman (R-AR), these reasons are rooted in “unacceptable” $250 billion spending by the USDA on TFP—which was supposed to have cost nothing—in the previous farm bill. Boozman made his sentiments known at a Senate Ag Committee farm bill hearing on nutrition on Thursday.

“Congress had no intention of your team spending that, and if you understood that was going to happen, you should have alerted Congress,” Boozman said to Cindy Long, USDA administrator. “How can we trust you going forward to give us advice? Spending a quarter of a trillion dollars from this committee is totally unacceptable.”

Related articles: How Long Does it Take to Write a Farm Bill?

While Boozman is adamant other program will suffer funding losses due to the “unsustainable” TFP increases in the coming bill, Senate Ag Committee Chairwoman Debbie Stabenow (D-Mich.) says that’s not the case.

“Whether commodity or SNAP programs go up or down, these monies aren’t traded. So, cutting SNAP won’t add money to the commodity title,” Stabenow says.

The 2018 bill enacted policy for a “thorough” farm bill update that hadn’t been done since 1975, according to Stabenow. She says the TFP increases fall under that update umbrella.

“The Trump administration chose not to use that [update and funding] because that was 2018—they chose not to proceed,” Stabenow rebutted. “The Biden administration came in and chose to proceed with those funds, and I’m glad they did.”

The General Accountability Office (GAO) has since determined USDA failed to submit the TFP food basket increase to Congress as a rule as required by the Congressional Review Act.

Row Crop Safety Net

Disaster programs such as the Market Facilitation Program (MFP), Coronavirus Food Assistance Program (CFAP), Wildfire and Hurricane Indemnity Program Plus (WHIP+) and Emergency Relief Program (ERP) saw billions of dollars moved from taxpayers to producers in the past 10 years, with USDA reporting the largest spike in 2020 at $45 billion.

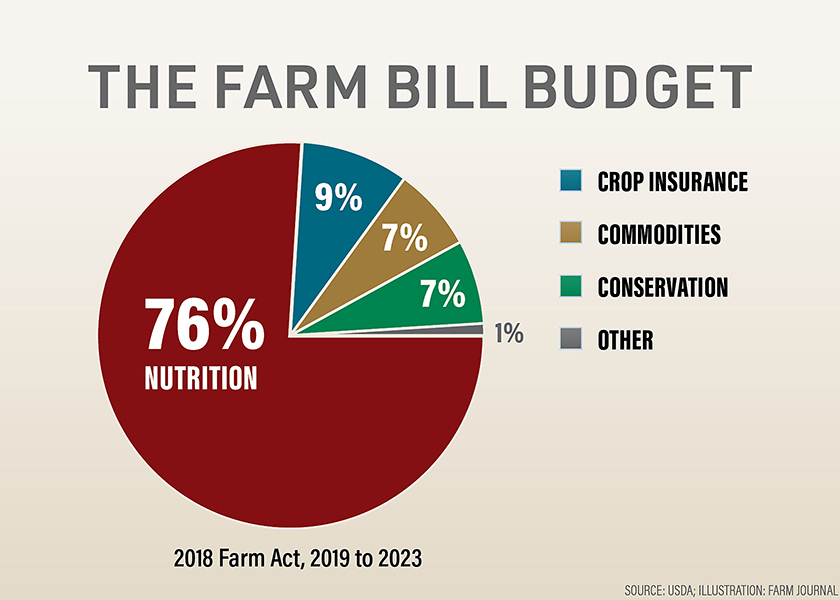

According to estimates from the House Ag Committee, CBO’s 2023 baselines compared to the 2018 farm bill will cause changes over the five-year period in:

• Commodity programs—12% decrease

• Conservation—19% increase

• Nutrition—82% increase

• Crop insurance—26% increase

However, CBO’s latest baseline provides no built-in ad hoc for these programs.

“If Congress doesn’t provide more funding/investments for Title 1, it puts pressure on farm-state lawmakers to continue the billions in ad hoc aid,” Wiesemeyer says. “Some analysts say reforming Title I would mean spending far less than continuing ad hoc assistance. If Title I is not made more effective, farmers will keep wondering if Congress will fund more emergency aid.”

Related articles: The Cost of a Farm Bill: 2023 Row Crop Priorities

GAO released a report stating that those wanting to change crop insurance program features will try to use to their advantage.

Here are the changes GAO says Congress could make to mitigate the programs costs:

• Reduce subsidies to high-income participants by creating an income limit.

• Adjust compensation to insurance companies to better align with market rates.

Livestock Safety Net

Dairy and livestock did, however, receive a safety net mention in CBO’s baselines.

Under the Dairy Margin Coverage (DMC) program, CBO forecasts FY 2023 payments will total $194 million in FY 2023, with those increasing to $248 million in FY 2024 and $266 million in FY 2025. For the rest of the period—through FY 2033—they are forecast between $196 million and $265 million, for a total of $2.531 billion.

Livestock disaster payments are expected at $621 million in FY 2023 and forecast between $562 million to $591 million over FY 2024 to FY 2033, for a total of $6.333 billion.