Farmland Values Normalize in Grain Belt States

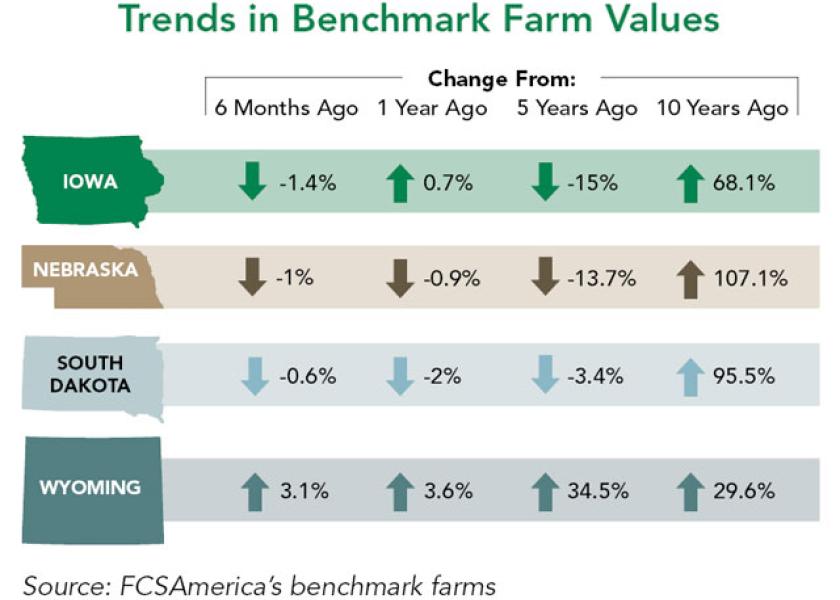

The pace of farmland-value drops has slowed in several areas but remain stable, according to a recent report from Farm Credit Services of America (FCSAmerica). Values largely held steady through the last half 2018 for the 64 benchmark farms FCSAmerica monitors in Iowa, Nebraska, South Dakota and Wyoming.

Iowa farmland values are largely unchanged from a year ago, while Nebraska and South Dakota each saw modest declines for the year. Only Wyoming experienced an uptick in benchmark farmland values.

“The softening of the market in the latter half of 2018 wasn’t unexpected and, in fact, it better aligns farmland values to profitability in the grain sector,” says Tim Koch, chief credit officer for FCSAmerica. “While producers in many areas of our territory benefitted from strong yields in 2018, the industry continues to be challenged by compressed margins. For producers who rent farmland, softening in the market will help their bottom line.”

Compared to the market’s peak, farmland values are down 19.5% in Nebraska, 18% in Iowa and 12% in South Dakota, according to FCSAmerica.

Overall, farmland values are expected to trend back to normalization, says Jim Knuth, senior vice president Farm Credit Services of America.

“The market has been able to digest this move back to normalization,” says Knuth, who spoke at last week’s Peoples Company Land Investment Expo in Des Moines, Iowa.

Profits, revenue, margins, current results and future expectations all drive farmland values, Knuth says. For example, net farm income has fallen 40% to 50% from its peak, while land values only declined 15% to 20%.

“We continue to see a tug-of-war or correlation disconnect between land valuations and the reality of the revenue stream currently being produced by land,” Knuth says.

Continued pressure on profit margins could lead to additional softening in 2019, according to the FCSAmerica report. However, the same factors that have helped to stabilize the market for the past three years remain in place, including interest rates near historic lows and strong demand for quality land that is in tighter supply.

Read more farmland price analysis:

3 Factors That Could Topple Farmland Values

2019 Farmland Outlook: Values Stay Resilient