Jerry Gulke: Is the 800-lb. Gorilla Back?

It appears phase one has done what it was supposed to do — get Chinese demand for U.S. soybeans back on track. What is open to debate is if China is buying soybeans to just meet phase one, if they need to import more soybeans from all sources or if they are buying for food security purposes.

The world has chewed through much higher Brazilian production than reported, further suggesting total global demand was higher. Brazil is basically out of exportable supplies until February 2021. Argentina might have stocks, but theirs is a currency issue.

If the final soybean yield falls below 49 bu. per acre, things could change dramatically. While excellent, that yield suggests 300 million bushels fewer than previously thought. If so, we might have wiped out enough crop to see U.S. carryout as low as 275 million bushels.

All this is happening before planting the crop in Brazil, where now most analysts are estimating 135 million metric tons of new crop production.

An unexpected acreage battle could emerge, especially if Brazil has less-than-stellar yields. U.S. corn might need to battle with soybeans for acres in 2021/22.

The Bottom Line

We are likely turning the corner on the past trend of higher and higher world stocks and adequate stocks-to-use ratios. However, if the above positive events materialize, a significant drop in U.S., Brazil and Argentina (G3) stocks would cause an even tighter balance sheet.

A 50-bu.-per-acre national average soybean yield could add $75 per acre in income (a $6 billion increase in revenue for the U.S. soybean crop) compared to this past April.

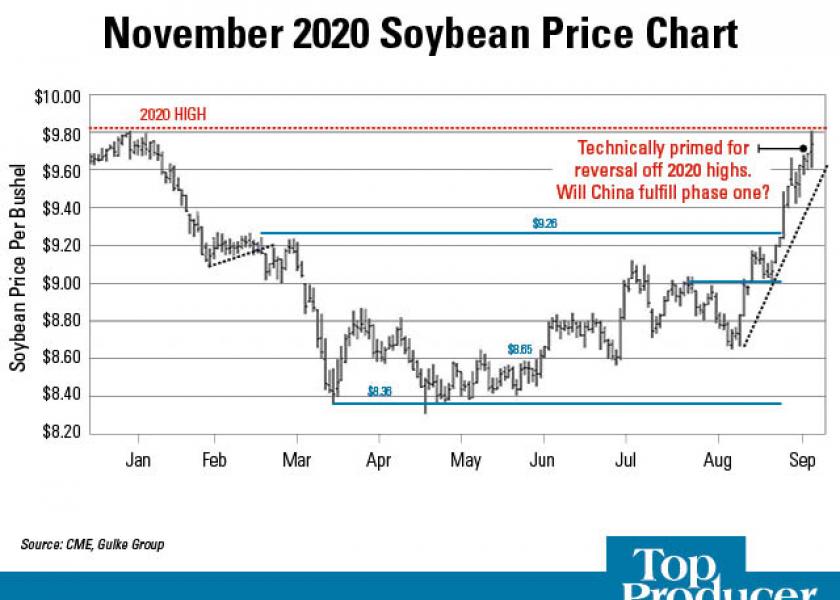

Soybean prices hit the highs for 2020 in mid-September. Selling some production meant profits for most. In marketing, I expect to make mistakes; I just don’t want to make big ones. Capturing a profit after what we’ve been through this year isn’t going to be a big mistake. Even if grain prices go higher, I win.

The mistake would be not grasping the opportunity. My timing of further sales will be aided by technical signals.

Read More

Jerry Gulke: Has the Grain Market Psychology Changed?

Jerry Gulke: Lessons Learned in 30 Years of Grain Marketing

Jerry Gulke: Will USDA Report Cause Pre-Harvest Lows?

Find more written and audio commentary from Gulke at AgWeb.com/Gulke

Check the latest market prices in AgWeb's Commodity Markets Center.

Jerry Gulke farms in Illinois and North Dakota. He is president of Gulke Group, a market advisory firm. Disclaimer: There is substantial risk of loss in trading futures or options, and each investor and trader must consider whether this is a suitable investment. There is no guarantee the advice we give will result in profitable trades. Past performance is not indicative of future results.