Could Unprecedented Cuts in WASDE Set the Stage for Unprecedented Prices?

Market Reaction to USDA Report 111220

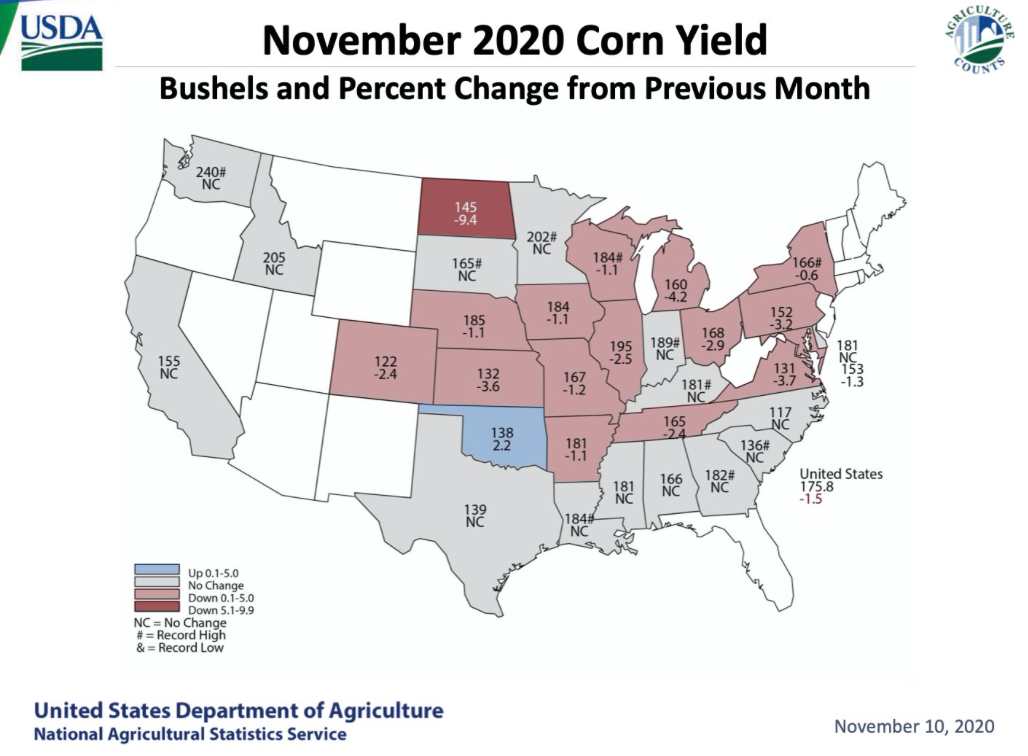

USDA provided more fuel for the commodity markets Tuesday. In a WASDE and Crop Production report the market viewed as bullish, the agency slashed the national corn yield from 178.4 bushels per acre in October, to 175.8 bushels per acre in its latest forecast.

USDA’s yield forecast map shows every state, except Oklahoma, is seeing a yield forecast lower or right at levels reported in the October report.

“The change and decline in production were unusually large this month,” says Seth Meyer, associate director of University of Missouri’s Food and Agricultural Policy Research Institute (FAPRI). “We normally don’t see such big adjustments from October to November. So that was a big change that put support under prices and why we saw things jump at report release.

Soybean Supplies Tighten

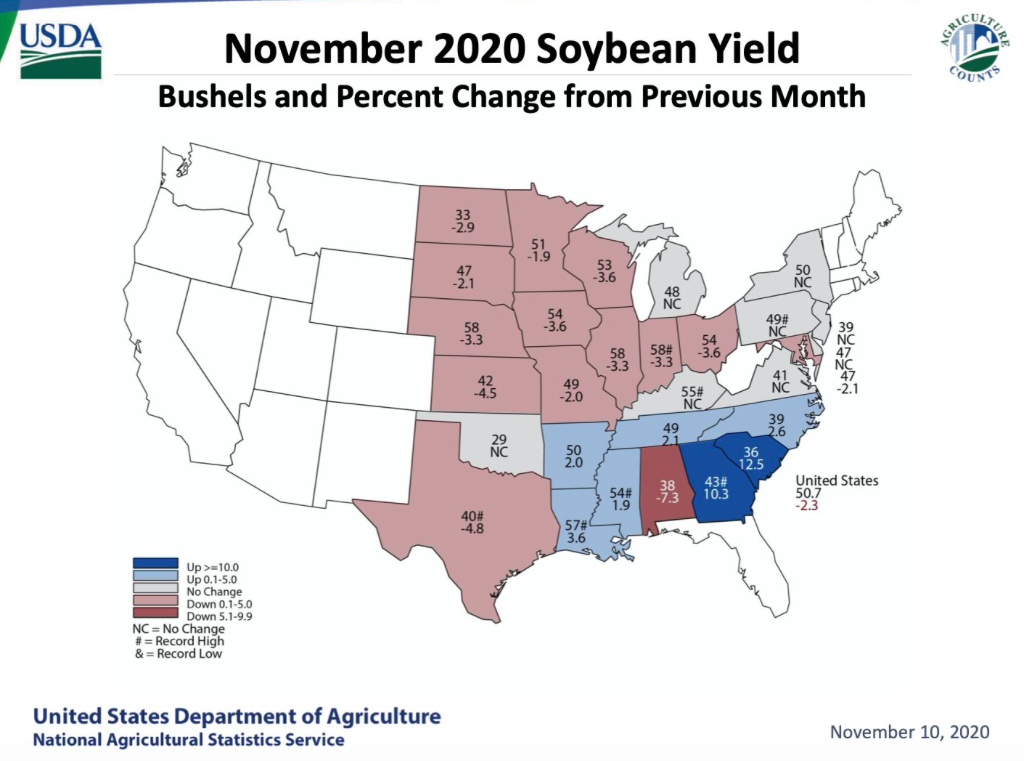

The corn crop wasn’t alone. USDA also trimmed the national soybean yield by just over a bushel, from 51.9 bushels per acre in its October report, to the latest November projection of 50.7 bushels per acre.

The agency cited farmers in major soybean production states of Illinois, Iowa, Indiana and Ohio saw lower yields, which attributed to the yield reduction in its forecast.

Demand-Driven Market Continues

It wasn’t just supply supporting the market Tuesday. The export story was also friendly. USDA also gave an optimistic export forecast, as it raised corn exports to a new projected high. Part of that equation was USDA raising China’s corn imports to 13 million metric tons.

“USDA did increase Chinese corn imports by 6 MT to 13MT, despite Chinese officials, just this morning, leaving their import forecast at 6 MT,” says DuWayne Bosse of Bolt Marketing. “In my opinion, they will import more than 13 MT. Some estimates even point to China importing closer to 20 MT.”

China Equation Conundrum

Did USDA adjust its forecast for China too much or not enough? Meyer says the answer isn’t clear cut.

“That remains to be seen,” he says. “You know the story, sales are not shipments, and not optimistic for additional gains, grains markets are getting tight.”

Tuesday’s report also revealed a soybean ending stocks picture projected to be the tightest in seven years. Bosse says the soybean market may still have more room to move higher.

“For soybeans, the stocks to usage ratio is tight enough the market feels we need to ration demand, meaning we need to rally the price until demand starts to decrease,” he says. “What price that takes will depend on how strong the demand is from countries like China. In many ways, $11.50 beans are still relatively cheap, so my advice, buckle up!”

Biggest Risk to Markets in Months Ahead

With the cuts to overall yield and production, the market seems unstoppable, and Meyer thinks the potential biggest downside risk to the market may not hit until 2021.

“The biggest downside risk to the market is the Brazilian crop area is larger than expected,” he says. If they have a great crop - or the Chinese have secured everything they need, that would weigh on the market. But one can tell the opposite of those stories, too.”

Bosse says his biggest caution to the market is the long position funds hold in corn, but thinks CFAP will also play a role.

"For corn, the biggest anchor moving forward will be farmer selling," says Bosse. "I don’t see that happening in the short-term. Farmers sold soybeans early in this rally due to a tight basis and profitable prices. They also received CFAP checks this year. By selling beans and receiving disaster payments, the need for cash is very low. Farmers can hold onto corn for quite some time. I don’t think farmer selling will pick up until the beginning of 2021 when cash corn sales will go onto their next taxable income year."

Start of 2020 Bull Market?

So, is agriculture seeing the start of the next bull market?

“I don’t know what the technical qualifications are for a bull market, but we have certainly set the stage where we are going to need a couple of good crops in South America and North America to settle the market,” says Meyer. “U.S. corn and soybean stocks both getting very tight. Just look where we have been on those soybean stocks from the height of the trade war where carryout was expected around 900 million bushels to today where we are 190 million bushels. It’s a night and day difference.”