Corn Prices Climb as China Commits to Biggest U.S. Ethanol Purchase Ever

Corn prices climbed double digits on Tuesday. The market was fueled by news China made its biggest buy of corn in six months.

“53.5 million bushel corn buy all at once is the biggest sale that would have corn that we've had to China's since July,” says Arlan Suderman of Stonex Group. “It’s pretty significant and helps explain why we saw the big run up in prices on Monday with some follow through today.”

More than corn, China hinted at a historic ethanol purchase, committing to buy the most ethanol it’s ever bought in a year, and China says it will do so in the first six months of 2021.

During its investor call Tuesday, ADM’s CFO Ray Young said China bought roughly 200 million gallons of ethanol for the first half of 2021, a move Young said could bring optimism for ethanol’s recovery this year.

But just how big of a deal is China’s 200-million-gallon ethanol buy? If China follows through with shipments, it would be the biggest annual buy ever by China, and happen in just six months.

“This would be a significant purchase,” says Ed Hubbard, general counsel and vice president of government affairs with the Renewable Fuels Association (RFA). “It would be something that would shake the industry up. The challenge, though, is that we have to wait and see whether or not it actually materializes.”

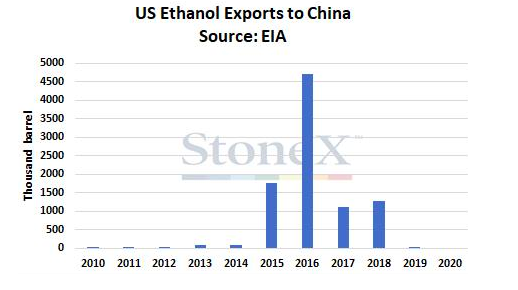

Hubbard says the last time China purchased close to this much ethanol was in 2017, when its annual purchases amounted to 198.1 million gallons.

“We were seeing volumes from starting in 2013, rising from about 23 million gallons to about 50 million gallons and then by 2017, they peaked at 198.1 million gallons,” he says. “We just topped it with this commitment, which is huge. I mean, 2017 was a peak, and now China has the potential to be our number one, two or three market. This is key for the industry, it's something to be positive about. “

Suderman says historically, China was a major purchaser of U.S. ethanol. Ethanol buys from China started revving up in 2013.

“They've had quite a history of buying ethanol. And then that all started to shut down a few years ago, and particularly with the trade war, that was one of the things that I was really watching after the Phase One trade agreement. I thought if they're really serious about that trade agreement, we would see some of the barriers to importing ethanol and distillers grains be lifted. We still have not seen the barriers to distillers grain [lifted], it is good to see some of the ethanol and I think it's an indication of the high price corn that they have in China now, that they're trying to cut back on industrial demand in order to save for feed demand. “

Demand will be key. Hubbard agrees China’s commitment signals the demand in China is strong, and could also hint at China’s eagerness to live up to its Phase One trade promises.

“This is something significant,” says Hubbard. “This is a firm commitment to purchase 200 million gallons within the first half of the year. And it is consistent with the Phase One agreement. This is actually something that that we would have liked to have seen earlier last year, but we do think that one of the big obstacles of these transactions will be to convert the purchase commitments to shipments.”

More Buys on the Way?

China is committing to these purchases as ethanol still faces early 50% tariff heading into China. Despite the tariffs still in place, could more buys be on the way? The ethanol industry is hopeful.

“200 million gallons would be the biggest purchase in any year,” says Hubbard. “And that’s just a commitment for the first half of 2021. So, theoretically, if we see further purchases after you know, this 200 million initial purchase for 2021, then it will soar past obviously, there's a great possibility it'll soar past previous records.”

Hubbard thinks it’s no coincidence that this large purchase comes on the heels of the Biden inauguration last week. Suderman also thinks the timing is key.

“I think one of the big questions has been will China test the Biden administration as they test many administrations when they come in,” says Suderman. “It looks like they're starting off with throwing the Biden administration a carrot. It looks like they’re going make some purchases of ethanol, which were rumored last week already, and also a big purchase of corn to try to influence the Biden administration in a positively.”